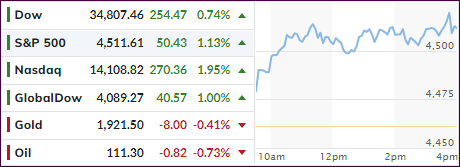

- Moving the markets

After yesterday’s drubbing, short-term market direction reversed again with the major indexes recovering just about all of Wednesday’s losses.

A drop in jobless claims to the lowest in decades provided the backdrop and gave confidence that the economic recovery remains on track, despite much evidence to the contrary.

Hope that a ceasefire in Ukraine could be forthcoming may have been just overly optimistic thinking, but it helped to support the bullish mood, nonetheless.

Bond yields spiked again with the 10-year adding 7 bps to close at 2.368%. Global bonds are still suffering the largest drawdown on record, as ZH pointed out, as yields slowly but surely pick up upward momentum.

The US Dollar inched higher, Crude Oil got hammered back to the $110 marker, while Gold had a solid session by adding +1.30%.

The 2/10 yield curve has now inverted meaning that 2-year bond yields are higher than 10-year ones. This has always been a precursor to a recession, as Bloomberg demonstrates in this chart.

Should that happen, Wall Street traders will be a happy bunch, because it means that lower rates hopefully will be on deck again.