ETF Tracker Newsletter For July 26, 2024

ETF Tracker StatSheet

You can view the latest version here.

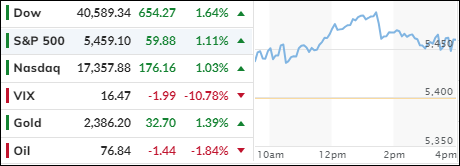

MARKET AWAITS KEY MACRO EVENTS AFTER WEEK OF MIXED PERFORMANCES

- Moving the market

Today, stocks staged a notable comeback, attempting to recover some of the declines experienced earlier in the week as traders analyzed the latest inflation data.

Several factors contributed to this rebound: Market sentiment was oversold, Thursday’s GDP report exceeded expectations, and there is growing optimism that the Federal Reserve may soon soften its interest rate policy.

June’s Personal Consumption Expenditure Price Index (PCE) rose by 0.1% month-over-month and 2.5% year-over-year, both figures aligning with estimates and providing no negative surprises.

Traders continued to rotate into cyclical sectors and Small Caps, which gained an additional 2%. Industrials, real estate, and financials also showed signs of recovery. The Dow led the charge with a 1.6% gain, partly driven by 3M’s impressive 20% surge, marking its best day since 1972.

The tech sector, however, faced a challenging period, with the MAG 7 stocks losing approximately $2 trillion in market value. Small Caps outperformed the Nasdaq, adding 3% while the Nasdaq lost 3%, a scenario reminiscent of the dotcom bubble peak.

Bond yields slipped as expectations for rate cuts increased slightly. The dollar edged higher, gold rebounded but closed lower for the week, and Bitcoin showed a mixed performance, bouncing back strongly to touch the $68k level. Meanwhile, oil prices declined.

Next week promises to be the busiest of the summer, with numerous macro events on the horizon, including the Federal Reserve meeting, CPI data, and earnings reports from 40% of the S&P 500 companies. These events are likely to significantly influence market direction.

But which way will the market go?

Read More