- Moving the market

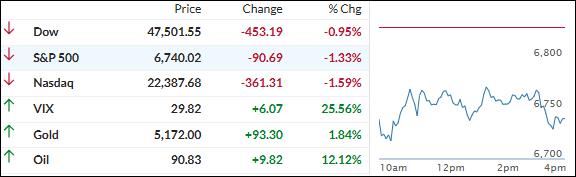

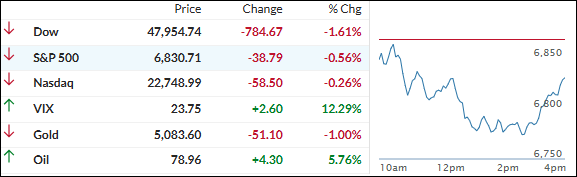

Stocks opened deep in the red as U.S. oil futures smashed through $100 a barrel (hitting over $119 overnight—the highest since 2022), sparking fresh fears of a stagflation scenario with rising inflation and slowing growth.

The spike came after major Middle East producers slashed output due to the ongoing closure of the Strait of Hormuz. Kuwait announced cuts (details TBD), and Iraq reportedly saw production drop 70%.

Wall Street saw $100 oil as a potential breaking point for the economy unless the conflict cools fast.

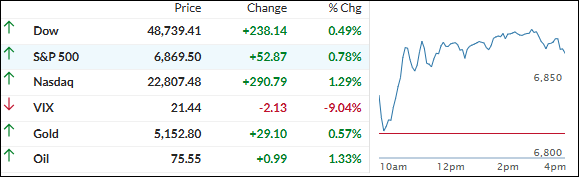

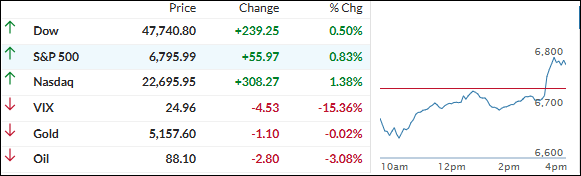

President Trump’s Sunday comment that the war is “very complete” and ahead of his initial 4–5-week timeline (“They have no navy, no communications, no Air Force“) flipped the mood. Bulls charged back in, pushing the major indexes to a solidly green close and erasing the early losses.

Bond yields tumbled on Trump’s remarks (easing inflation fears), the dollar reversed its overnight spike and ended lower, gold rallied toward $5,150 but fell just short of green, and silver held steady.

Bitcoin stayed bullish all day, climbing back above $69,000.

Big picture: the Middle East war rages on, inflation is sticky and now faces a supply shock, the labor market is stalling, the Fed is boxed in, tariff policy is in legal chaos, and private credit stress is still simmering.

Today’s comeback was welcome, but it hasn’t erased the challenges ahead.

Read More