- Moving the market

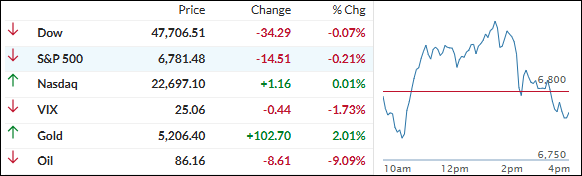

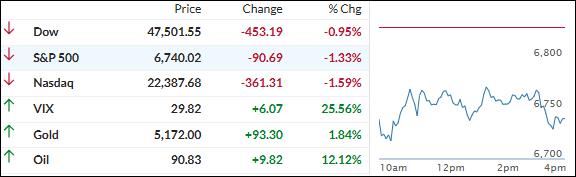

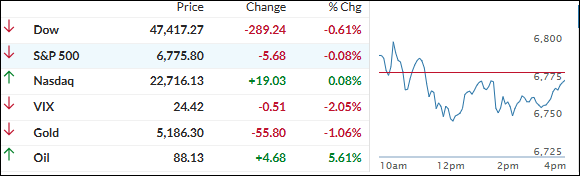

The major indexes opened lower as traders kept one eye on the ongoing U.S.-Iran conflict and oil prices, which spiked early on worries about supply disruptions.

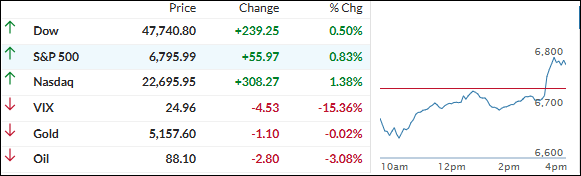

The Dow was the biggest laggard, but the broader market got a lift later when the International Energy Agency announced it would release 400 million barrels from its reserves—the largest-ever drawdown—to help offset the war-related supply squeeze.

Overnight reports added to the tension: U.S. forces reportedly sank several Iranian ships (including 16 minelayers) near the Strait of Hormuz, where Tehran had been trying to mine the route.

But President Trump had said earlier this week that the war would end “very soon,” which reinforced hopes for a quick de-escalation and helped calm nerves.

The February CPI came in at 2.4% year-over-year, right in line with expectations, following recent signs of a softening labor market. That gave the Fed a little breathing room but didn’t spark any fireworks.

Oracle was the day’s standout, jumping 10% after beating Q3 earnings and revenue and raising its fiscal 2027 forecast.

The Mag 7 managed to outperform the rest of the S&P 493 despite some afternoon fading, while an early short squeeze in small caps lost steam.

Bond yields rose sharply (taking some wind out of equities), the dollar gained, gold lost its $5,200 handle again, and Bitcoin dipped mid-session but rallied briefly above $71K before settling with a small gain.

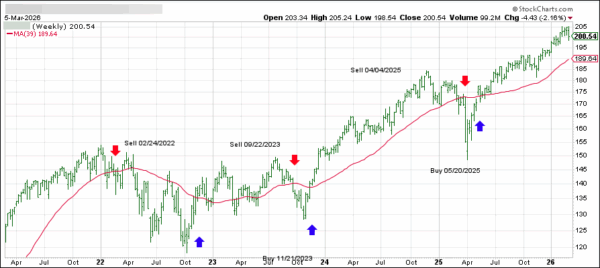

As we’ve seen all week, this market can swing violently in both directions on headline ping-pong—today was no exception.

Read More