- Moving the market

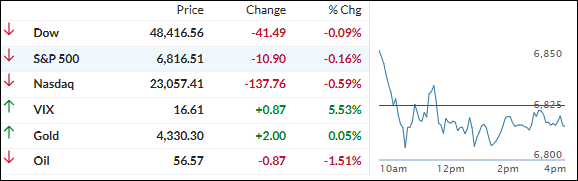

The markets started the day on shaky footing, with the S&P 500 and Nasdaq slipping while the Dow briefly held modest gains as traders sifted through the long-delayed jobs data and tried to gauge the real state of the economy.

After weeks of trading on hope, yesterday’s report made it clearer that growth has been cooling for a while, and attention is already shifting to Thursday’s November CPI release to see whether inflation is easing enough to justify more support next year.

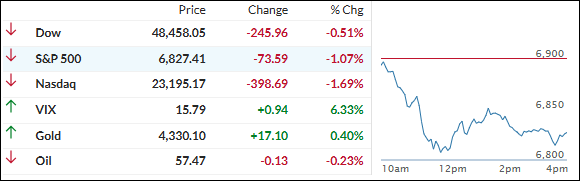

The real hit came from the AI story line. Oracle slid another 5% to its lowest level since mid‑June as fresh “data center drama” reignited worries about the pace and profitability of big AI investments, and AI stocks more broadly have now dropped about 9% over the past week.

That knocked the wind out of the Nasdaq, which was hit hard and lost its 50‑day moving average, while the Dow held up relatively better; as a group, the Mag 7 names lagged the other 493 S&P components by a wide margin, underscoring how leadership has been wobbling.

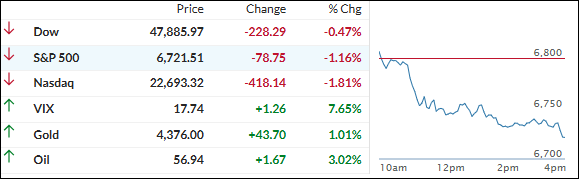

Crypto traded like a roller coaster, with Bitcoin spiking from around 86k up toward 90k before sliding back toward 85k by the close.

Precious metals, on the other hand, continued to act as a stabilizing force: silver ripped higher again, gaining roughly 4.4% as it pushed toward 67 before falling just short, and gold added about 1% but bumped into resistance near 4,350.

Bonds chopped around intraday, but yields remain lower on the week, offering at least a bit of support to risk assets in the background.

With only seven trading days left in the year, AI heavyweights stumbling, metals leading, and the macro picture looking softer but not outright broken, the big question is this one:

Can seasonality finally step in and give equities the year‑end tailwind they’re looking for—or if 2025 is destined to limp into the finish line instead of sprinting.

Read More