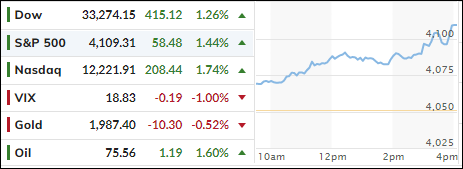

- Moving the markets

The markets pulled back right after the opening, in part due to uncertainty about yesterday’s spike in oil prices and how it might affect the global economic environment.

Not helping matters were a host of econ data showing that a slowdown had indeed arrived, as the Labor market appears to have fractured with job openings and new hires showing deteriorating numbers; their lowest since May 2021.

At the same time, US Factory Orders slipped to 2.7%, a number we have not seen since February 2021. The Citi economic Surprise Index shifted into reverse and, at least for the moment, the adage “bad news is good news” bit the dust.

Apparently, similar weakness was also found in other countries’ s backyards, as the Central Bank of Australia joined the Canadian one in “pausing” on rate hikes.

Hmm, does that mean the Fed will follow suit?

While that is not clear yet, the fallout made itself felt across a variety of markets. The major indexes only corrected moderately, as “most shorted” stocks collapsed. In other words, the squeeze play had run out of ammunition.

With these overwhelming weak data points, it came as no surprise that bond yields tumbled, as the 2-year “lost” its 4% level. The US Dollar succumbed to dovish news and pulled back to its 2-month lows.

Benefiting from this unsure environment was Gold, as the precious metal stormed higher by almost 2% and closed solidly above its much fought-over $2k level at $2,039.

Right now, we are witnessing the worst of both worlds, namely higher inflation, due to a reduction in oil production, while a deteriorating economy warrants a bailout via lower interest rates.

That makes me ponder: Will the Fed continue its hawkish policy to save the dollar, or will they fold by pausing or lowering rates to save the economy?

Hmm…

Read More