ETF Tracker StatSheet

You can view the latest version here.

ENDING THE MONTH ON A POSITIVE NOTE

- Moving the markets

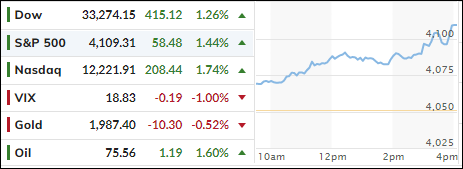

It was only three trading days ago when the S&P 500 had finally climbed back to a point where its performance was even for the month, after having been clobbered during the banking crises.

From that moment in time, the major indexes ramped higher, as banking fears evaporated, thereby saving the month and the quarter from a dismal performance. Today’s boost came thanks to a softer reading from the Fed’s favorite inflation indicator, namely the core PCE (Personal Consumption Expenditure index).

It was expected to come in unchanged at 4.7% but instead improved a tad to its lowest since October 2021 (4.6% YoY). That was music in the ears of traders and algos alike, and the Ramp-A-Thon continued throughout the session.

After having been absent since March 28th, a short-squeeze was activated and provided the much-need firepower to close this week on a bullish note. Of course, a bull market scenario can’t live on short covering alone, real buyers are needed to support this effort over the longer term. We will find out next week if the past 3 days were indeed nothing but quarterly window dressing.

For sure, the month of March was not a smooth ride due to the failure of two reginal banks and a forced takeover of Credit Suisse. While this 3-day rally helped market sentiment, the crisis has been merely put on the backburner and could very well reappear without much warning.

Why?

Because all banks are fractionally operated, meaning they only have a portion of your money on deposit, and are therefore potential victims to sudden massive withdrawals. Bloomberg looked at where we are in this chart when considering the bigger picture, so caution is warranted in terms of the magnitude of market exposure.

While the S&P’s comeback, and recapture of the 4,100 leve,l is indeed impressive, it’s noteworthy, as ZH pointed out, that its performance in Q1 was dominated by just 15 stocks,

Bond yields rose for the week, and Gold continued its top performance (up over 19% in the last 6 months, its best gain since 2016). The precious metal has now scored its highest quarterly close in history with a March gain of almost 9%.

With recessionary bells ringing, could this rebound be again part of the strong conviction that some “easing” by the Fed is warranted—despite their hawkish tones?

2. “Buy” Cycle Suggestions

For the current Buy cycle, which started on 12/1/2022, I suggested you reference my then current StatSheet for ETF selections. However, if you came on board later, you may want to look at the most recent version, which is published and posted every Thursday at 6:30 pm PST.

I also recommend you consider your risk tolerance when making your selections by dropping down more towards the middle of the M-Index rankings, should you tend to be more risk adverse. Likewise, a partial initial exposure to the markets, say 33% to start with, will reduce your risk in case of a sudden directional turnaround.

We are living in times of great uncertainty, with economic fundamentals steadily deteriorating, which will eventually affect earnings negatively and, by association, stock prices.

In my advisor’s practice, we are therefore looking for limited exposure in value, some growth and dividend ETFs. Of course, gold has been a core holding for a long time.

With all investments, I recommend the use of a trailing sell stop in the range of 8-12% to limit your downside risk.

3. Trend Tracking Indexes (TTIs)

A surprise reading of the PEC inflation index helped the markets to ramp higher, which benefited both of our TTIs. Next week, we will see if this 3-day rally truly has legs.

This is how we closed 03/31/2023:

Domestic TTI: +2.27% above its M/A (prior close +0.98%)—Buy signal effective 12/1/2022.

International TTI: +7.02% above its M/A (prior close +6.52%)—Buy signal effective 12/1/2022.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli