- Moving the markets

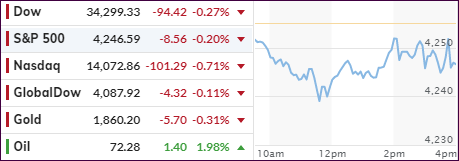

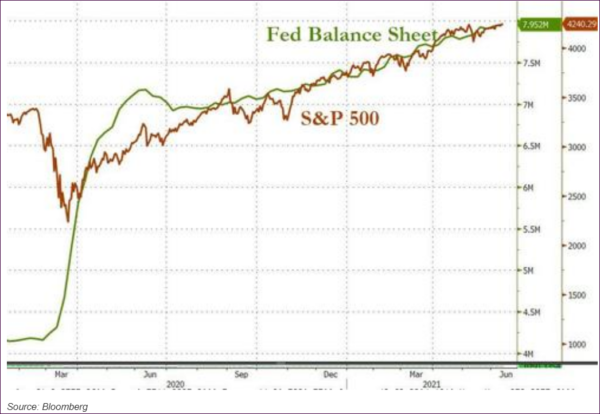

The morning, after the Fed’s announcement that it envisions two rate hikes in 2023, thereby subtly admitting that inflation may not be transitory, traders were shocked to see today’s market reaction, as this chart demonstrates.

ZeroHege described it this way:

Traders are watching in stunned amazement at what is going on in the market where contrary to everything the Fed has said, we are seeing a stampede into tech, growth, and duration-sensitive names…and a flight out of reflation and value sectors…

Bonds were in a world of their own when, after yesterday’s yield spike, which represented a normal reaction to potentially higher rates, opposite day arrived and slammed yields lower back down to the June 11 level. The 30-year yield crashed down to a price last seen on November 20.

Huh? Even seasoned traders watched this unreal development open-mouthed and were not able to come up with a reasonable explanation. Bank stocks got hit hard, which pushed the Financial Sector ETF down -2.90%. The US Dollar surged for the 5th straight day, as ZeroHege pointed out, thereby clubbing Gold like a baby seal, which slumped -4.68% and dropped below its $1,800 level. Ouch!

It was a day where nothing made sense and even the inflation-sensitive commodity sector got annihilated and suffered its biggest drop since March 2020. In other words, things that should not have happened did happen.

In the end, it may not have been the Fed causing havoc in some market sectors, but what is about to take place tomorrow. That is massive options expirations in SPX and QQQ with a total value of some $2 trillion!

What we saw today may have been just a front run of tomorrow’s main feature.

Read More