- Moving the markets

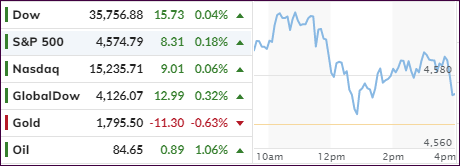

Despite an early pump, which was quickly followed by a dump, the major indexes successfully battled the unchanged line, which turned out to be a springboard for a bounce into the close. In that process, the Dow and S&P 500 set new all-time highs, thereby maintaining the bullish theme into the first day of November.

The overall gains were modest, but SmallCaps ended up having their best day since the end of August with a solid advance of 2.6%. However, the assist came from a sudden short squeeze, which helped the levitation. Tesla showed another mind-numbing gain of 8.5%, after having the crossed the $1 trillion market cap last week.

While corporate earnings season dominated the picture last month via solid profits, more announcements are on the agenda this week and might lend further assistance to the bulls. Other market affecting events will be the outcome of a 2-day Fed meeting ending this Wednesday and the all-important October jobs report, which is due on Friday. Expectations are for an increase of 450k jobs.

Bond yields edged higher, while the US Dollar went nowhere. Neither one of those moves proved to be a detriment for Gold, which steadily moved higher and closed the session with a 0.61% advance, but it stopped just short of the magic $1,800 level.

It was a good start to a new month after the stellar October performance.

Read More