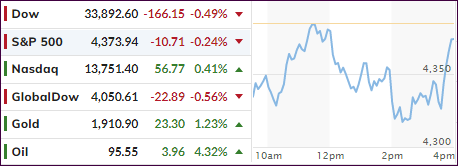

- Moving the markets

As the Russia-Ukraine conflict spreads and intensifies, it should come as no surprise that equities eventually would be affected negatively. We have seen some late session comeback attempts, but current geopolitical conditions may make it very difficult to continue these efforts.

The reality, that sanctioning others may have a boomerang effect came into play today, when crude oil surged over to $100, making future gasoline price hikes at the pump a virtual certainty. Commodities rallied in sync, with my favorite index (DBC), which we own, spiking 4% on the day.

With our domestic Trend Tracking Index (TTI-section 3 below) diving deeper into bear market territory, equities seem to be stuck in a fog of uncertainty and lack incentive to stabilize—at least for the time being.

Bond yields around the world crashed, with some having their biggest drops since 1992 (UK-10-year). While US banks were the worst performers today, their European cousins were in much worse shape, down some 25% in the last few days, as Bloomberg shows here.

Here at home, the 10-year yield tumbled to below 1.7%, a level last seen at the beginning of January. All other maturities showed similar performances. With the flight to safety on traders’ minds, the US Dollar rebounded and closed higher.

Gold did what it’s supposed to, namely rally during times of uncertainty, and the precious metal did not disappoint, as it surged +2.57% for the session.

Among all this upheaval, the Atlanta Fed announced their GDP estimate for Q1 2022. I hate to be the bearer of bad news, but the number they spewed out was a big fat ZERO. In other words, no growth, and when coupling this with the inflationary trends we’re seeing, it appears to me that “Stagflation” is now firmly baked into the cake.

Read More