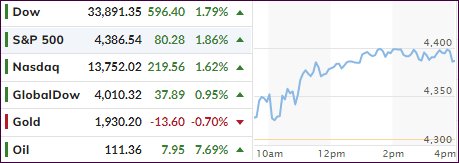

- Moving the markets

I noted my surprise on Friday that equities had not been more negatively affected by the geopolitical events, but that notion seemed to have changed today.

One look at the S&P 500 chart above tells the story that the bears ruled supreme and, at least for the time being, won the tug-of-war against the bulls by severely spanking the major indexes.

The decline was broad, except for certain sectors that were rewarding to be invested in. You can view some of those candidates in my latest Thursday StatSheet.

The actors participating in today’s market smacking were the same from last week, ranging from geopolitical events to inflation fears, GDP heading towards zero and supply chain issues, especially in the energy sector. The realization has now set in that the dreaded “S” word, as in Stagflation, can now no longer be ignored, as the economy appears to be in the process of rolling over.

Some traders called the current market to be dysfunctional, while being concerned that credit default swaps may not pay out in case of a default. As ZH noted, part of the reason is that Russian equites have fallen by an absurd amount with one index (GDR) plunging a mind-boggling 97% in just a few days while wiping out some $572 billion. For sure, there will be fallout effects around the world.

Added ZH:

There is no other way to describe today’s market carnage than a market in turmoil where things are rapidly breaking as commodity collateral is suddenly sparking contagion and liquidations.

Then this:

The Nasdaq tumbled 3.6% with the help of Facebook and Moderna both of which have wiped out more than 50% of their value from all-time highs and is now down more than 20% from its all-time high, closing in a bear market, where it joins the Russell, which is now also down more than 20% from ATH.

Europe performed even worse with the well-known Stoxx index now in bear market territory and having reached its lowest level since November 2020. Ouch!

Bucking the trend were gold, energy, and commodities, which appear to provide some stability in an increasingly unstable world, the latter of which was even admitted by the White House:

- WHITE HOUSE SAYS U.S. NEEDS TO BE PREPARED FOR LONG, DIFFICULT ROAD AHEAD