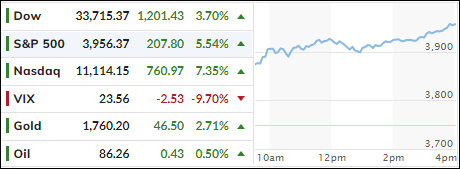

- Moving the markets

After last week’s Ramp-A-Thon, equities needed a breather. Even though the major indexes held up well throughout the session by bouncing around their respective unchanged lines, momentum waned during the last hour and south we went.

Given the advances of the past five trading days, a pause was in order, and that’s exactly what developed this afternoon. The question now remains if traders’ sentiment is bullish enough to build on recent gains to sustain upward momentum—even at a slower pace— during this seasonally strongest period of the year before the reality of fragile earnings sets in come 2023.

Two dovish and hawkish messages by a couple of Fed mouth pieces cancelled each other out but caused some whipsaws during the session with the S&P being unable to hang on to its $4k level.

Bond yields went sideways, the US Dollar was flat, but gold managed to score a +0.33% gain and kept inching closer to its $1,800 level.

The S&P is now 3.03% away from breaching its widely watched 200-day M/A, a key resistance level which, if broken to the upside, could give technical traders encouragement that the rally will continue, as third quarter earnings season moves into its 9th inning.

Read More