- Moving the markets

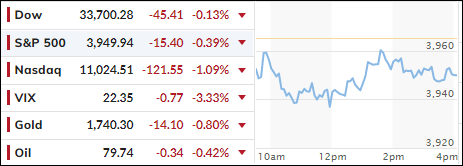

The major indexes shed some more of their recent gains during this first day of a Holiday shortened trading week. Not helping the already jittery market were reports of China possibly ramping up Covid restrictions due to some additional deaths and the lockdowns spreading.

As a result, the Chinese Yuan plunged, and the US Dollar continued its 4-day uptrend.

That means the much hoped for reopening may not pan out as planned, thereby putting the discussion of a global economic recovery back on the front burner. Still, the recent bear market bounce may find some support in the form of reduced trading this week, as traders take time off, which can increase volatility due to lower volume.

If there are no market news, rumors can give an assist. This was the case today, when speculation surfaced that OPEC+ was considering production hikes causing Crude Oil to tank, shortly after which the denial was published, which then created this silly chart.

The most shorted stocks continued their unwind process from the post-CPI squeeze, as ZeroHedge put it, which again tells me the importance a short squeeze has when to comes to creating or sustaining bullish momentum.

Bond yields went predominantly sideways, gold faded, and the Fed’s Terminal Expectation rate moved back to its cycle highs above the 5.08% mark. Again, the much hoped for pause or pivot (to lower rates) is nowhere to be seen.

Read More