- Moving the markets

A bucking bronco type of market behavior seemed to be perfectly complementing this election day with its own ups and downs, irregularities, and accusations.

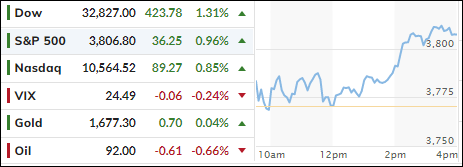

The major indexes stormed out of the gate and ripped higher with the Dow at one point sporting a 500-point gain, which collapsed, as the index almost broke below its unchanged line. However, bullish momentum reappeared, and all the majors managed to score a green close.

The initial ramp was based on traders’ hopes that in case the Republicans take back the House, a gridlock in Washington would be the result, a scenario which is viewed as a positive because, with a divided Congress and President, government spending, new taxes and regulations will be limited. At least, that’s the theory.

The US Dollar plunged to 7-week lows and, as ZeroHedge pointed out, is its biggest 3-day dive since March 2020. As one analyst noted, “it’s been the dollar’s demise that has been driving this bounce in stocks…”

The beneficiary was gold, as the precious metal spiked +2.13% to over $1,700, which represents a 5-week high. Also giving an assist to stocks were declining bond yields, as market expectations for Fed rate trajectories changed from hawkish to dovish today.

Should market election probabilities not be met, we will see this bear market rally hit the skids, which it may do anyway, should Thursday’s CPI report confirm that we have not yet hit peak inflation.

Read More