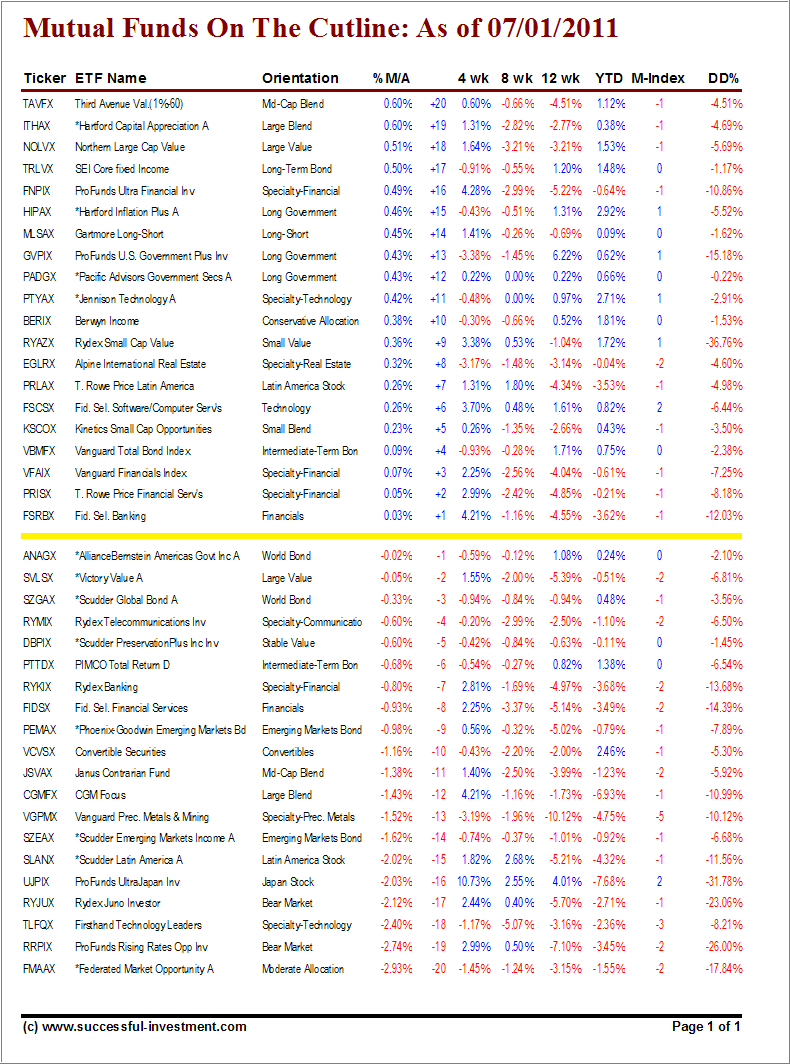

Just like in yesterday’s ETF Cutline report, the rally of the past 5 days pushed many mutual funds out of negative territory, below the cutline, right through the first +20 listings above the cutline.

If you track any mutual funds, you know need to consult the weekly StatSheet for the exact location of those you are interested in. Consult the appropriate sections.

During the sharp rebound, some momentum figures have clearly improved, but they are still inconsistent at best. Additionally, the DrawDown numbers (DD% column) have not yet risen enough to wipe out the red figures, which means that in many cases we are still closer to a sell signal than reaching new highs.

Take a look:

[Click on table to enlarge, copy and print]

As a consequence of these fairly high DrawDown number, most funds remain a “hold,” subject to their trailing sell stops being triggered, and not a buy to deploy new money.

Quick reference to recent issues:

Disclosure: No holdings

Contact Ulli