- Moving the market

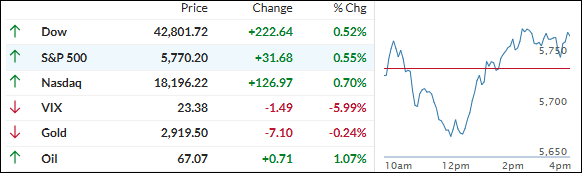

Today’s better-than-expected CPI report gave the major indexes a positive start, with all of them opening higher and maintaining that trajectory throughout the session.

The Consumer Price Index increased by 0.2% for the month, resulting in an annual inflation rate of 2.8%, which is lower than the estimated 0.3% monthly increase and 2.9% annual rate.

The Core CPI, which excludes food and energy prices, also rose by 0.2% for the month and 3.1% over the past 12 months, both figures coming in below expectations.

This data alleviated recent fears, at least temporarily, that Trump’s trade policies would lead to higher inflation and slower growth, potentially causing “stagflation.” Traders are now considering the possibility that this outcome might give the Federal Reserve some room to cut interest rates later this year.

Looking deeper, there is a notable divergence as the widely followed S&P 500 index is outperforming its equal-weight counterpart, indicating that today’s rally was not broad-based.

Bond yields edged higher, as did the dollar, but its weakness during afternoon trading pushed gold to near-record highs. Bitcoin remained rangebound and closed roughly unchanged.

Another divergence that could threaten equities is the S&P 500’s apparent disconnect from economic data points.

Read More