ETF Tracker StatSheet

https://theetfbully.com/2017/12/weekly-statsheet-etf-tracker-newsletter-updated-12142017/

EXTENDING THE WEEKLY GAIN STREAK

[Chart courtesy of MarketWatch.com]- Moving the markets

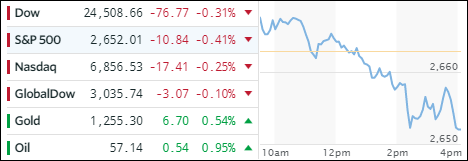

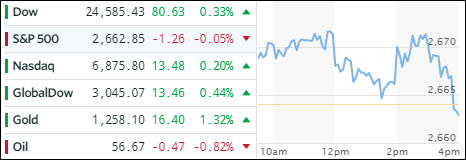

When looking at yesterday’s weakening market action, today can only be described as “opposite” day, as senators Rubio and Corker fell in line and announced a “Yes” vote to the long overdue agreement on Trump’s tax plan, as a last minute expansion of the child tax credit proved to be the solution. While this vote may not be chiseled in stone, it created enough optimism to torpedo the major indexes into record territory—again.

Equities scored some nice gains, and in ETF land we saw mostly green numbers. The only exception was International Equities (SCHF), which slipped -0.09%. On the plus side, we spotted several ETFs with gains above 1%. The number one spot was taken by our standby favorite, namely Semiconductors (SMH) with +1.64%. In close pursuit were Aerospace & Defense (ITA +1.62%), US SmallCaps (SCHA +1.24%) and MidCaps (SCHM +0.84%).

While the 10-year bond remained unchanged, the action was in the longer dated securities with the 20-year rallying +0.38% and honing in on its 2017 high as the yield curve continues to flatten (meaning that long term yields are falling while near term yields are rising). The US dollar (UUP) bounced back from its recent sell off and gained +0.41%.