- Moving the markets

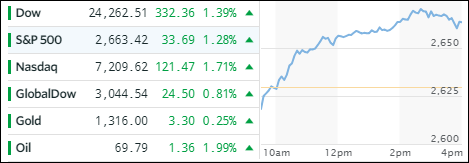

The much awaited and hyped up announcement by President Trump regarding the Iran nuclear pact had the major indexes, which hovered below their respective unchanged lines all morning, dipping down at first but managing to rebound to close essentially unchanged. Trump confirmed withdrawal from the pact and announced “the highest level of sanctions against Iran.”

While details were lacking, the markets pretty much took it in stride—so far—with most of the volatility occurring in the oil sector. The defense arena benefited as Israel bomb shelter headlines seem to play the drums of war. Domestically, Transportations lead with +0.76%, followed by Semiconductors and SmallCaps with +0.70% and +0.49% respectively.

Helping the markets gain some footing, after Trump’s announcement, was the VIX, which got pushed down to the 14 level thereby making sure that the Iran uncertainty supported the bulls and not the bears. Interest rates rose slightly with the 10-year bond yield creeping closer the 3% level, while the US Dollar (UUP) kept his recent strength alive by gaining +0.37%.

I don’t the market reaction to the Iran drama is over yet, and we’ll have to see how things play out over the next few days.