ETF Tracker StatSheet

FRIDAY SAVES THE WEEK

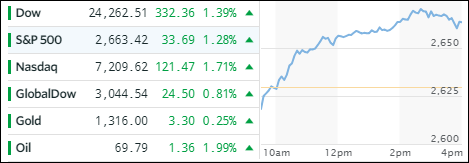

[Chart courtesy of MarketWatch.com]- Moving the markets

After slipping and sliding all week, the bulls finally regained some strength and pulled the major indexes out of the doldrums with the S&P 500 almost getting back to last Friday’s close.

The big mover was Apple, which was responsible for some 50 points of the Dow’s 332 point gain, for no reason other than reports that Warren Buffett bought 75 million shares. Apple not only surged to record highs but also helped the Dow to score its best day in 3 weeks after having fallen in 9 of the past 13 sessions.

This helped traders to shove reports of tense China trade talk negotiations on the back burner, but I am sure it will be moved to headline news again next week once concrete results emerge.

Of course, a rebound rally would not be complete without input from the Fed. Two of their mouthpieces appeared to cheer on the markets.

First, it was John Williams who declared that they are “comfortable overshooting 2% inflation for a while,” which was followed by Bill Dudley’s “I don’t think the Fed cares about financial markets per se.” That was enough to overshadow any weakness caused by the weaker-than-expected April non-farm payroll report, which some analysts graded with a “C-.”

On the week, the major indexes and bonds were saved by closing just about unchanged, helped in part today by the fact that shorts were squeezed and had to cover resulting in the Dow and S&P 500 now having successfully bounced off their 200-day M/As—again, thereby extending the bullish theme a little while longer.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

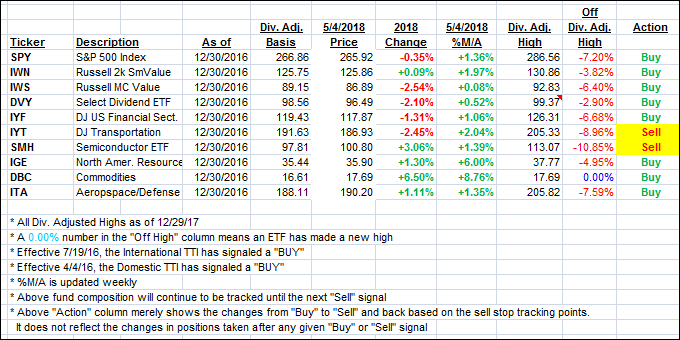

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) rallied helped by the weekending rebound.

Here’s how we closed 05/04/2018:

Domestic TTI: +1.23% above its M/A (last close +0.75%)—Buy signal effective 4/4/2016

International TTI: +1.37% below its M/A (last close +0.99%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & As

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli