I won’t be able to make it back in time to write today’s market commentary. The next post is scheduled for tomorrow.

Ulli…

I won’t be able to make it back in time to write today’s market commentary. The next post is scheduled for tomorrow.

Ulli…

Even though the futures markets benefited for a little while from Microsoft’s blow-out earnings yesterday, that positive sentiment did not last long with the major indexes plunging right at the opening of the regular session.

A few factors came into play and contributed to today’s plunge:

The events around GME, along with others, and the pain experienced by the leveraged short-sellers were worsening, as the stock catapulted to the $385 level. It’s almost funny when you consider that based on economic analysis heavy shorting by the pros of this stock backfired, after an army of retail speculators poured into the stock via massive share purchases and options and drove it to higher highs in the process forcing the shorts to cover thereby throwing more gasoline on the fire.

In the end, not only did the short sellers tried to cover, but they also had to face gigantic margin calls, which caused them to sell off any asset they held indiscriminately, thereby contributing to today’s broad sell off.

In other words, amateur traders made the pros puke their longs to cover their short losses. Ouch!

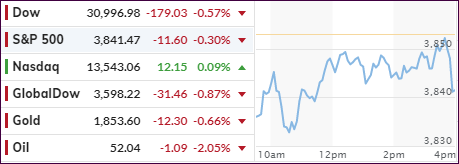

To no surprise, bond yields dropped to 1%, and the US Dollar rallied. With the major indexes surrendering 2%-2.5%, Gold held up well during this Sell-A-Thon by only giving back -0.65%.

To show you how downright stupid some of the market moves were, ZH pointed to the holding company for Blockbuster’s liquidation, which is up a rather amusing 4,900% in the last two days, as this chart shows.

Let’s see if that kind of insanity continues tomorrow. I will be pressed for time and may write an early and shortened market commentary, if possible.

Read More

The direction the futures markets take is not always an indication as to what will happen during the regular trading session. Such was the case last night, with the major indexes were down some -0.5%, but they opened in the green yet ended up meandering aimlessly all day.

Even Nasdaq trading was subdued with Big Tech earnings on deck, as well as a slew of reports from blue-chip companies, as we are heading to the center of the earnings season.

Volatility reigned supreme in some areas, as CNBC reported:

Wild swings resumed in heavily shorted stocks, including GameStop and AMC Entertainment, as enthusiastic retail investors active in chat rooms continued to bet against short-selling hedge funds. The volatility has some investors concerned about stocks becoming detached from fundamentals as speculation runs rampant.

As I have pounced on for years, fundamentals are no longer important, it is reckless and rampant speculation mixed with complacent and bubbly investor sentiment, all of which can potentially have a negative effect on the markets. But right now, “fear not,” seems to be the meme, “the Fed has our back and will do anything in their power to not let markets collapse.”

In the meantime, the Fed began its two-day meeting and tomorrow’s policy statement will be analyzed down to every word to be sure that any potential market rescue efforts remain in place.

While I am writing this, Microsoft just reported blowout earnings, which should bode well for the direction of the Nasdaq tomorrow.

Despite the major indexes being flat today, the biggest 3-day short squeeze since March/April last year pushed the most-shorted stocks back to record highs, as ZH reported.

The US Dollar drifted lower, but Gold could not find the spark to use that weakness as a springboard for advances, so the precious metal remained stuck in its current trading range.

Oh well, tomorrow is another day.

Read More

One look at the above chart tells you that an early excursion above the unchanged line came to a sudden halt, when the bottom dropped out with the major indexes doing their best imitation of a swan dive.

Even the Nasdaq, up early by +1.3% lost it all, crashed into the red, but managed to recover almost half of it, as the afternoon levitation pulled the major indexes out of the doldrums and towards green territory, with only the Dow failing to reach it.

Stimulus plan optimism fizzled somewhat after news that a bipartisan consortium was attempting to cut down the proposed $1.9 trillion figure. Adding to the sour mood were rising Covid cases and delays in vaccines supplies and distribution logistics.

Still, I have to wonder if something broke in the markets this morning, since there was no known major event that might have caused the indexes to react like this and the 10-year yield plummeting like shown here.

Adding to this debacle were reports of investors having difficulty accessing their accounts with ZH summarizing it as follows:

Despite all that, the early trapdoor closed again, and the steady afternoon comeback pushed the S&P 500 up by +0.36%, a small margin, but large enough to register a new record.

However, contributing to today’s volatility was a company called GME, which experienced an insane short squeeze leaving both, shorts and longs, scratching their head and wondering what happened. This chart shows the ride.

In terms of earnings, CNBC summed it up like this:

Companies kicked off the earnings season on a strong note. Of the S&P 500 components that have already reported earnings, 73% have beaten on both sales and EPS, according to data from Bank of America. The firm said this is tracking similar to last quarter when the number of companies beating hit a record.

I have talked about the dangers of sudden volatility before, and I am sure we have not seen the last of it.

Read MoreBelow, please find the latest High-Volume ETF Cutline report, which shows how far above or below their respective long-term trend lines (39-week SMA) my currently tracked ETFs are positioned.

This report covers the HV ETF Master List from Thursday’s StatSheet and includes 312 High Volume ETFs, defined as those with an average daily volume of more than $5 million, of which currently 269 (last week 267) are hovering in bullish territory. The yellow line separates those ETFs that are positioned above their trend line (%M/A) from those that have dropped below it.

Take a look:

The HV ETF Master Cutline Report

In case you are not familiar with some of the terminology used in the reports, please read the Glossary of Terms. If you missed the original post about the Cutline approach, you can read it here.

ETF Tracker StatSheet

You can view the latest version here.

GLIDING INTO THE WEEKEND

The futures already gave a preview of how the regular session might turn out, as the stimulus driven rally was overpowered by news of tighter and extended coronavirus restrictions, which would have adverse economic effects.

On the other hand, after a week solid gains, any excuse was welcome for traders to take some money off the table causing the major indexes, except for the Nasdaq, to slide into the weekend.

For the week, the Nasdaq rocketed +4.2% higher, while the Dow and S&P 500 added +0.6% and +1.9% respectively. SmallCaps (IWO) joined the rally by gaining +2.00%, but growth stocks and big tech names ruled.

In terms of more stimulus, opinions and viewpoints do not always align, as CNBC pointed out:

A growing number of Republicans have expressed doubts over the need for another stimulus bill, especially one with a price tag of $1.9 trillion proposed by Biden. Meanwhile, Democratic Sen. Joe Manchin has criticized the size of the latest round of proposed stimulus checks. Dissent from either party carries weight for Biden, who took office with a slim majority in Congress.

Be that as it may, it’s a foregone conclusion in my mind that stimulus plans of enormous magnitude are on deck, and it’s just a matter of time until they make their presence felt, which will have a negative effect on current low bond yields.

Michael Maharrey from Schiff Gold posted this question:

Why are interest rates at record lows?

The reason is simple; the Federal Reserve is artificially keeping them there.

The Process:

When Uncle Sam borrows money, it puts upward pressure on interest rates. The more bonds the Treasury Department issues, the lower the price falls because market demand can’t keep up with supply. Bond yields inversely correlate with bond prices. As the price of bonds drops, interest rates rise. This is simple economic calculus.

Enter the Federal Reserve. The Fed buys bonds on the open market (quantitative easing), creating artificial demand and propping prices up. This keeps interest rates artificially low.

So far, so good. But there is a small hitch in this process. The Fed buys these bonds with money created out of thin air and injects this money into the economy. This is inflation. And it’s precisely why the money supply increased at a record pace in 2020.

And this is exactly why I believe that every investor needs to have an allocation to Gold in his portfolio. It may not matter now, but the time will come, when it suddenly does.

Read More