- Moving the markets

Even though the futures markets benefited for a little while from Microsoft’s blow-out earnings yesterday, that positive sentiment did not last long with the major indexes plunging right at the opening of the regular session.

A few factors came into play and contributed to today’s plunge:

- The markets melted up over the past couple of months in almost a vertical fashion, supported by intense speculative behavior from retail investors, so a correction has been way overdue.

- All eyes were on the Fed today, which opted to hold interest rates near zero and left unchanged its massive bond-buying program. Fed head Powell stressed that the economy remains far from a recovery, a point that I have repeatedly made.

- The short squeeze of stocks like GME continued unabated causing some of the billionaire hedge fund shorts a world of hurt with some of them likely needing to be bailed out.

The events around GME, along with others, and the pain experienced by the leveraged short-sellers were worsening, as the stock catapulted to the $385 level. It’s almost funny when you consider that based on economic analysis heavy shorting by the pros of this stock backfired, after an army of retail speculators poured into the stock via massive share purchases and options and drove it to higher highs in the process forcing the shorts to cover thereby throwing more gasoline on the fire.

In the end, not only did the short sellers tried to cover, but they also had to face gigantic margin calls, which caused them to sell off any asset they held indiscriminately, thereby contributing to today’s broad sell off.

In other words, amateur traders made the pros puke their longs to cover their short losses. Ouch!

To no surprise, bond yields dropped to 1%, and the US Dollar rallied. With the major indexes surrendering 2%-2.5%, Gold held up well during this Sell-A-Thon by only giving back -0.65%.

To show you how downright stupid some of the market moves were, ZH pointed to the holding company for Blockbuster’s liquidation, which is up a rather amusing 4,900% in the last two days, as this chart shows.

Let’s see if that kind of insanity continues tomorrow. I will be pressed for time and may write an early and shortened market commentary, if possible.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

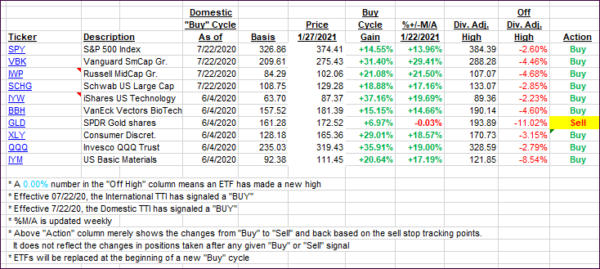

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs plunged, as the bears oversaw the markets.

This is how we closed 1/27/2021:

Domestic TTI: +14.97% above its M/A (prior close +17.68%)—Buy signal effective 07/22/2020.

International TTI: +14.42% above its M/A (prior close +16.65%)—Buy signal effective 07/22/2020.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli