- Moving the markets

The market mantra of the past few weeks of “digging a hole and climbing out of it” failed miserably today, as dip buyers remained conspicuously absent thereby handing the directional baton to the bears.

A host of factors combined forces to pull the markets down, including Delta troubles, Fed taper talk, the upcoming debt ceiling battle, seasonality in that the second half of September has been historically one of the worst periods for stocks, inflation fears, and the fact that we are way overdue for a correction if not the bursting of the bubble.

The latter only needed a pin prick, and that may have just occurred via the collapse of the Evergrande empire, a massive Chinese property developer with worldwide projects, which has become insolvent because of $300 billion in bad loans. Their stock plunged 80% YTD.

This story has been developing over the past week or so, with fears increasing that the cockroach theory may play out again in that there is never just one. While we don’t know the other names yet, contagion has already begun as a variety of Chinese construction/real estate ventures are collapsing and developers and industrial producers getting punished.

Some analysts have referred to Evergrande as being the next Lehman Brothers, the demise of which was instrumental in collapsing the financial markets in 2008.

All this uncertainty resulted in equities being hit, but it’s noteworthy that a last hour rebound prevented a worse outcome. It remains to be seen whether there is more downside to come, or if dip buyers will re-appear.

There were no winners, but as was to be expected bond yields dropped, and the US Dollar rode the range but closed about unchanged. Gold was the shining star by gaining +0.79%, which was one of the few green numbers on the computer screens.

We have now reached a point where markets could break either way, meaning they could recover or the bubble might burst entirely, which brings up the interesting question as to whether history might repeat itself, as Bloomberg demonstrates in this chart.

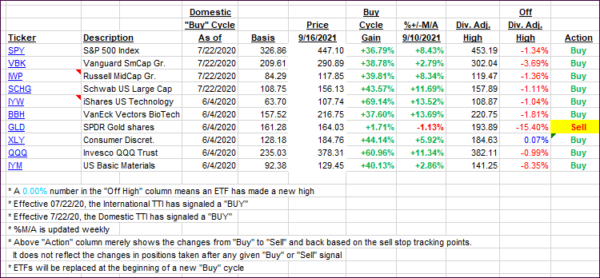

That is why it’s critical to have an exit strategy in place designed to prevent the participation in the worst-case scenario. As you know, I use a combination of trailing sell stops and my Trend Tracking Indexes (TTIs). You can see their latest update in section 3 below.

My posting schedule for this week has slightly changed again and is updated here.

Read More