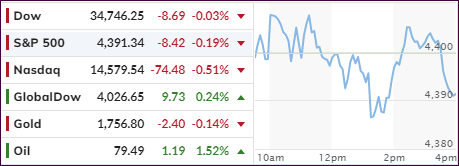

- Moving the markets

Two of the three major indexes found themselves in an early hole, but late session bullishness reversed the initial trend and assured a steady upward climb. The Dow reached its unchanged line, the S&P 500 ended up with moderate gains, but the Nasdaq bounced in the green all day and produced a solid advance of 0.73%.

The 3-day losing streak is now in the rearview mirror with some support coming from the widely analyzed FOMC report, which showed that the Central Bank could begin tapering its asset-purchase program as soon as by the middle of November:

Participants generally assessed that, provided that the economic recovery remained broadly on track, a gradual tapering process that concluded around the middle of next year would likely be appropriate,” the minutes said.

No surprises there, so traders focused on the CPI numbers. The index jumped 0.4% in September from the prior month and 5.4% year over year vs. expectations of 0.3% or an annualized rate of 5.3%. Of course, one analyst could not help himself by stating that most of these inflationary pressures are transitory. Yeah right.

The US Dollar dipped and ripped and then lost all momentum and closed down -0.51%, joined by 10-year bond yields, which also showed weakness. This combination, coupled with continued uncertainty, proved to be a boon for gold with the precious metal roaring towards its $1,800 level and gaining almost 2%.

Despite the rebound supported by dip buyers, there is one segment of the markets that still does not participate, as Bloomberg shows in this chart. Makes me wonder why…

Read More