- Moving the markets

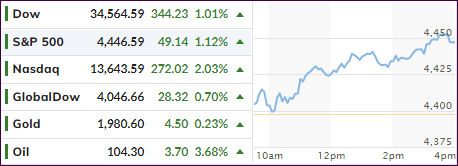

After three consecutive losing sessions, the major indexes managed to score a win, despite another horrific inflation number, which traders simply overlooked. Some corporate earnings came in better than expected (BlackRock, Fastenal, Delta) with the latter one announcing the return to profitability this quarter.

Other airlines, hotel, and travel stocks joined the rebound, which was led by the Nasdaq with a 2% gain.

The much-awaited Producer Price Index (PPI) jumped a mind-boggling 11.2% YoY in March, while the MoM gain came in at 1.4%, far higher than the expected 1.1%. This follows yesterday’s CPI number, which surged 8.5% YoY in March.

As strange as it may sound, but in the face of the above numbers, bond yields pulled back with the 10-year settling at 2.697%, down 8 basis points.

Crude Oil ripped higher despite the greatest SPR (Strategic Petroleum Reserve) release ever, which was pushed into the background on news that Russia is shutting down oil production at a more rapid rate. That will likely reverse the tiny reduction in gas prices of the recent past.

Gold maintained its upward momentum and is heading closer to breaking its $2k glass ceiling again.

Read More