ETF Tracker StatSheet

You can view the latest version here.

TRYING TO OVERCOME FED ANGST

- Moving the markets

A former Fed president said what he was not allowed to when he was in office, namely that the Fed needs to push down equities to get inflation under control. This was followed by a current Fed member uttering that he wants the Fund Funds rate at 3.5% by the end of this year.

Both comments should have been enough to send the bulls packing, but instead, after an early drop, an algo driven rebound pushed the major indexes in the green, with the Dow at one point sporting a 230-point gain.

However, in the end, only the Dow eked out a meager advance during another whip-saw session that merely represented the continued tug-of-war between bulls and bears with the latter scoring a win for the week.

Even the most optimistic Wall Street bulls can no longer ignore the changing tone of the Fed, which continues to signal a more aggressive stance towards fighting inflation. Even the Fed’s Bill Dudley explained that, after watching stocks rise, this simply means “The Fed will just have an even bigger bubble to crash in order to get inflation under control.”

This was very apparent in bond land with the 10-year jumping sharply by 9 bps to close the day at 2.707%. The US Dollar followed suit and reached its highest level since July 2020, as ZH pointed out.

Despite the strong dollar, gold and silver inched higher this week with gold adding another 0.54% during today’s session. My favorite energy ETF for this environment had another great showing with a day’s gain of +2.68%.

Looking at the World GDP forecast and the World weighted inflation index, it’s clear that the dreaded “S” word, as in Stagflation, which I have repeatedly commented on, seems to be on deck, as Bloomberg demonstrates in this chart.

That translates to “equities beware.”

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

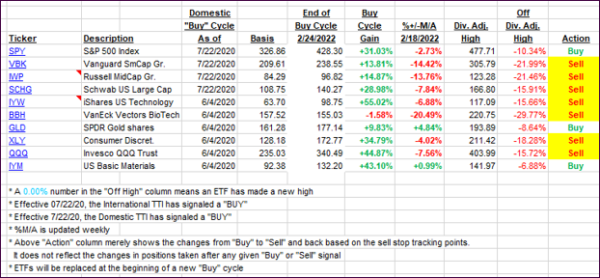

For this just closed-out domestic “Buy” cycle, here’s how some of our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -12% point has been taken out in the “Off High” column, which has replaced the prior -8% to -10% limits.

3. Trend Tracking Indexes (TTIs)

Our TTIs were mixed with the Domestic one slipping and heading closer to a break back into bear market territory. The International one improved slightly but remains below its respective trend line.

This is how we closed 04/08/2022:

Domestic TTI: +1.23% above its M/A (prior close +1.65%)—Sell signal effective 02/24/2022.

International TTI: -0.26% below its M/A (prior close -0.86%)—Sell signal effective 03/08/2022.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details.

Contact Ulli