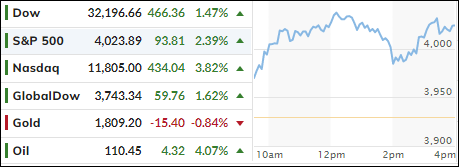

- Moving the markets

Despite yesterday’s bullish euphoria, reality set in today and informed those, who had not gotten the message yet, that we are indeed in bear market territory, in which hopeful bounces tend to die quickly.

Today’s action would be better described as a “puke fest,” with every asset class, except gold, being spanked with utter abandon. Pushing things in the wrong direction at the opening was retailer Target’s earnings and announcement about the damage inflation can do to profit margins due to higher fuel and compensation costs. The stock plunged some 25% with the fallout effect spreading to Walmart as well, which dropped 7%.

Trader’s pondering the theme “who’s next?” decided that dumping everything in sight was the best cause of action, as relentless selling picked up speed handing equities their worst day of the year.

Not helping markets at all was big-time investor and bubble market identifier extraordinaire, Jeremey Grantham, with this comment:

“The other day, we were down about 19.9% on the S&P 500 and about 27% on the Nasdaq. I would say at a minimum, we are likely to do twice that, if we are unlucky, which is quite possible, we would do three legs like that, and it might take a couple of years as it did in the 2000s.”

As Zero Hedge pointed out, stocks have now almost unwound all of the dead-cat bounce from last week, while the S&P 500 lost its 4k level once again. It’s also questionable whether the remaining rate hikes have been priced in, with Bloomberg referencing them in this chart. In other words, there may be more downside to come.

As was no surprise, Trucking stocks were hammered, bond yields retreated with the 10-year touching its 3% level but closing below 2.9%. Gold held up well during the debacle and scored some modest gains.

Looking at the big picture, could we see history repeating itself?

Read More