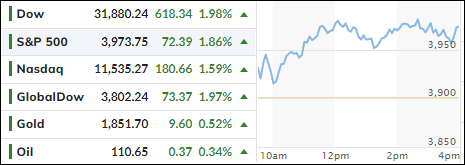

- Moving the markets

Nothing mattered today other the release of the Fed minutes. There were no surprises with the policy meeting notes showing that the Central Bank is prepared to raise rates further than anticipated.

This should have been reason enough for a sell off, but that did not happen. A deeper analysis of the minutes displayed some verbiage that possibly perhaps hinted at the Fed taking a pause of its hiking plan later this year.

That was enough to get the bullish juices flowing and the ensuing rally propelled the major indexes to intra-day highs, but momentum faded into the close. Still, all indexes managed to gain for the day.

Anxiety in the retail sector eased, as Nordstrom’s and Dick’s Sporting Goods surpassed earnings, with the former even raising its full-year outlook. Both stocks climbed on the news.

The tech sector saw support due to some good news from Intuit, DocuSign, and Zoom Video. However, Macro Data was dismal with Durable Goods numbers coming in below expectations, but, if you need bullish support, you can always count on a short squeeze, and today was no exception.

Bond yields slipped again, despite a 50-bps hike in rates for June being now a foregone conclusion. However, as ZeroHedge pointed out, the odds of another 50-bps hike in July are fading modestly and are tumbling for September.

The US Dollar gained a tad but slipped into the close, while gold dipped and ripped but failed to reach its unchanged line.

ZH summed it up like this: Three more 50-bps hikes and then the Fed pauses… indefinitely; its next move a cut as the economic recession emerges from hiding.

Read More