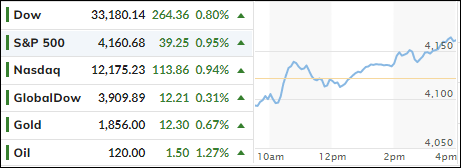

- Moving the markets

The roller coaster ride continued, as yesterday’s rebound vanished in a hurry, with the major indexes giving back more than they gained in the prior session. Bonds reversed Tuesday’s yield slippage with yields rising and the 10-year reclaiming its 3% level by closing at 3.03%.

Updates and warnings from major companies (Credit Suisse, Intel) contributed to equity weakness amid signs that economic growth is not what it was cracked up to be. In other words, we are slowing down with the Stagflation scenario becoming more real every day.

Things are starting to affect the housing market, because mortgage demand hit its lowest level in 22 years, as per the Mortgage Bankers Association. A rally in Crude Oil to over $122 only created more anxiety, but Natural Gas plunged due to a small terminal explosion. ZH explained that less exports means more domestic supply, hence the sell off. The reverse happened in Europe, as their supplies were cut and prices subsequently rose.

On deck for Friday is the highly anticipated CPI number for May. It’s reading could influence the path of Fed policy in terms of frequency (a potential pause) and magnitude (0.5% increments) and therefore affect market direction as well.

Read More