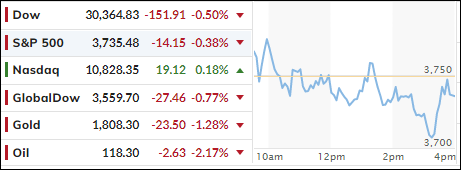

- Moving the markets

The much-anticipated Fed announcement came and went, with the Fed hiking rates by 75 basis points, its largest increase since 1994. They also hinted at a similar increase in July, which indicated some seriousness about its inflation fighting efforts, but it also caught traders of guard.

It’s been no secret that the Fed’s policy has been out of sync with inflation realities, so today’s aggressive stance pleased the markets—at least for the time being. The question remains whether the Fed is now hiking rates into a recession.

So far, the answer is “very likely,” as the Atlanta Fed slashed its Q2 forecast to 0.00% from the recent 0.9%, which means the US is on the verge of a technical recession after Q1’s contraction, as ZeroHedge called it.

Yet, Fed head Powell had this to say:

The US economy is in a strong position and well positioned to deal with higher interest rates.

There is no sign of a broader slowdown in the economy that I can see.

Hmm, I am sure that Powell will have eat these words eventually, in the same way he had to walk back the “inflation is transitory” scheme.

The markets took it all as a bullish sign, and after the recent drubbing managed to string together a green close. Sliding bond yields helped, with the 10-year dropping some 16 bps to close at 3.31%.

That downward action caused the US Dollar to puke and surrender some of its recent gains. The beneficiary was gold, which stormed out of the gate and ripped higher by +1.3%, while Crude Oil extended its recent losses.

In economic news, Homebuilder Sentiment tumbled back below pre-Covid levels, as ZH pointed out, and US Retail Sales unexpectedly tumbled in May and showed its first negative print since December 2021.

All this simply shows that the likelihood of “Stagflation” being in our future seems to increase on a daily basis.

Read More