ETF Tracker StatSheet

You can view the latest version here.

HAWKISH FED SPEAK OVERWHELMS MARKETS

- Moving the markets

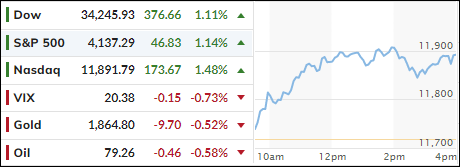

Yesterday’s thrashing of the markets continued early this morning, but the major indexes again climbed back, yet only the Dow was able to eke out a small gain.

Thursday afternoon, Fed mouthpieces Mester and Bullard combined forces to present a case for a bigger interest rate hike later this month, with Bullard not ruling out that he would support a 0.5% increase, thereby destroying hope that the expected 0.25% would be the new normal.

That pushed the terminal expiration date to almost 5.3% and clobbered any bullish market momentum with the Dow dumping over 400 points.

On the economic front, the various data points were bleak, as the manufacturing outlook tumbled to a 21-month low, jobless claims are hovering near one-year highs, housing starts showed their 5th straight monthly decline, Producer Prices surged more than expected, while Leading Indicators dropped for the 10th straight month.

Needless to say, none of these created any warm fuzzies for traders and down we went. That weakness continued throughout today’s session, and, in the end, the S&P 500 gave up its early gains and recorded a small loss for the week, while giving up the gains for the month, despite an afternoon short squeeze.

And again, traders and algos alike are not listening to what the Fed is saying and continue to hope that a soft landing is on deck followed by a pause/pivot after a couple of more rate hikes. Unless the Fed walks back their hawkish talk, a pivot will not happen in the foreseeable future.

Bond yields rose for the week, not helping the bullish theme, as the financial conditions have tightened somewhat, thereby aligning with the Fed’s hawkish monetary policy direction.

The US Dollar dumped for the day but gained for the week, while Gold retreated for the 3rd straight week after having risen for 6 straight weeks.

When charting stocks vs. balances at the Federal Reserve Banks, this chart makes it clear that those two move in sync most of the time. However, right now we are seeing a wide divergence making me ponder how this might end.

Hmm…

Read More