- Moving the markets

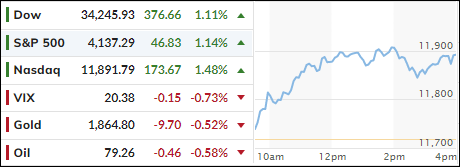

As we witnessed last month, traders maintained the same theme, namely front running the CPI report, on hopes that a weaker number will appear, which would persuade the Fed to take the foot of the hiking pedal, and that a more dovish stance towards interest rates would be appropriate.

The major indexes tried to regain their footing after the S&P and Nasdaq suffered their worst weekly declines in the past 2 months, so some bottom fishing contributed to today’s bullish sentiment.

All eyes are on tomorrow’s CPI report, which will shed some light on whether price increases have continued or slowed down because of the Fed’s hiking policy. As today’s action showed, traders are betting that inflation is cooling and that the Fed will finally relent and pause or pivot. I don’t think they are even close to that.

Any CPI surprise to the upside will pull the rug out from under the bulls and bring bearish forces back into play. Also, the earnings season will wind down later this week, and it has shown that, according to Credit Suisse, this was the worst earnings season in more than two decades when not counting recessionary periods.

Bond yields were mixed, but terminal rate expectations continued to rise, and financial conditions have started to tighten recently, as ZeroHedge noted. The US Dollar pumped and dumped, but it was not enough to keep Gold in the green, so the precious metal slipped.

Since everything gets charted these days, the consensus CPI forecast of 6.2% may very well be too conservative, if this forecast is spot on. Should recent history repeat itself, we should see a pullback tomorrow.

2. “Buy” Cycle Suggestions

For the current Buy cycle, which started on 12/1/2022, I suggested you reference my most for ETFs selections. However, if you came on board later, you may want to look at the most current version, which is published and posted every Thursday at 6:30 pm PST.

I also recommend for you to consider your risk tolerance when making your selections by dropping down more towards the middle of the M-Index rankings, should you tend to be more risk adverse. Likewise, a partial initial exposure to the markets, say 33% to start with, will reduce your risk in case of a sudden directional turnaround.

We are living in times of great uncertainty, with economic fundamentals steadily deteriorating, which will eventually affect earnings negatively and, by association, stock prices. I can see this current Buy signal to be short lived, say to the end of the year, and would not be surprised if it ends at some point in January.

In my advisor practice, we are therefore looking for limited exposure in value, some growth and dividend ETFs. Of course, gold has been a core holding for a long time.

With all investments, I recommend the use of a trailing sell stop in the range of 8-12% to limit your downside risk.

3. Trend Tracking Indexes (TTIs)

Our TTIs recovered from last week’s pullback and rallied with the major indexes.

This is how we closed 02/13/2023:

Domestic TTI: +8.14% above its M/A (prior close +6.94%)—Buy signal effective 12/1/2022.

International TTI: +9.84% above its M/A (prior close +9.04%)—Buy signal effective 12/1/2022.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli