- Moving the markets

The futures markets bounced around in record territory supported by positive earnings and continued prospects of much more stimulus as Biden prepared to take charge.

This bullish bias was sustained from the opening bell and, after a smooth transition of power, the major indexes shifted into overdrive and never looked back.

The top gainers in the ETF arena changed a bit when, after an early strong surge, SmallCaps (IWO) lost their momentum and closed off their highs but still with a respectable +0.41%, especially given recent stunning advances.

The Nasdaq ruled with a strong finish of +1.97%, but it was bested by one of our holdings, namely SCHG, which rose a chest pounding +2.63%. Even GLD, which traveled a roller-coaster all day, thanks to swings in the US Dollar, ended the day +1.62% but still short of its $1,900 level.

Of course, it’s all about the stimulus and hopes for a speedy recovery, no matter what the cost, however caution is warranted:

“The market is rallying on hopes for a speedier recovery,” Peter Cardillio, chief market economist at Spartan Capital, told MarketWatch.

But Cardillio also views equity market as “somewhat overbought” and likely due for a pullback, potentially once markets are confronted with the prospects of at least a partial rollback of Trump-era corporate tax cuts and a tighter regulatory environment. “There will come a point in time when the market will reflect on the new administration’s policies,” he said.

Still, traders were still clinging to Tuesday’s news, during which Janet Yellen, Biden’s designated nominee for Treasury Secretary, endorsed higher aid spending and urged lawmakers to “act big.” Maybe that was the true reason gold to take off today?

So far, earnings season has been viewed as a positive with solid quarterly results, but that is not such a big deal, if you consider that we are merely rebounding off the pandemic lows.

In the end, the eagerly awaited inauguration day came and went without interruption, so today’s ramp higher could certainly be interpreted as a relief rally.

It’ll be interesting to see if there is more follow through to the upside coming our way.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

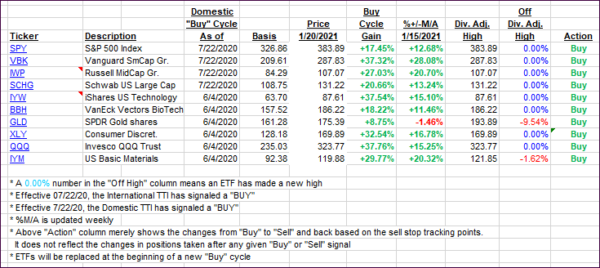

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs gained with the major indexes ending up in record territory.

This is how we closed 1/20/2021:

Domestic TTI: +20.62% above its M/A (prior close +19.87%)—Buy signal effective 07/22/2020.

International TTI: +19.64% above its M/A (prior close +18.79%)—Buy signal effective 07/22/2020.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli