- Moving the markets

Markets were in a bullish mood right after the opening bell and slowly ascended in anticipation of positive news from the Fed meeting.

That turned out to be the case, as the Federal Reserve left benchmark interest rates unchanged and promised to provide support until the threat of further negative economic impact by the coronavirus has passed.

Assurances and hints like “do whatever I can do for as long as it takes,” were enough to send stocks and gold higher, while the US Dollar continued on its southerly path. This was exactly what markets had expected, and up we went.

ZH summed it up like this:

Powell initially promised The Fed will “do whatever it takes for as long as it takes” and stocks and gold spiked.

Everything was fine until Powell reiterated a statement on the pace of recovery slowing and everything reversed.

But then Powell promised to “adjust forward guidance and asset-buying if needed” and the market assumed that if the recovery is slowing that can only mean MOAR!!!!

And stocks rallied back to their highs with Small Caps dramatically outperforming (as The Dow lagged) …

But, one portfolio manager was cautious:

“The market was operating under the assumption that the Fed will do whatever it has to do to support the market” and policy makers “didn’t disappoint on that front,” said Phil Toews, chief executive and lead portfolio manager of New York-based Toews Corp., which manages $1.9 billion.

“If markets falter over the coming months, the ability of the Fed to act as a put under the markets will be tested,” Toews said via email; “if markets begin to fall despite the Fed’s bond-buying power, it would be a tipping point that would be a huge sell indicator.”

I agree with this assessment, just because the Fed shows its willingness to support the markets, does not mean they will be able to execute as planned, but I am certain that their fortitude will be tested at some time in the future.

Tomorrow’s massive earnings reports will likely influence market direction, but for right now, we’re enjoying the bullish ride.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

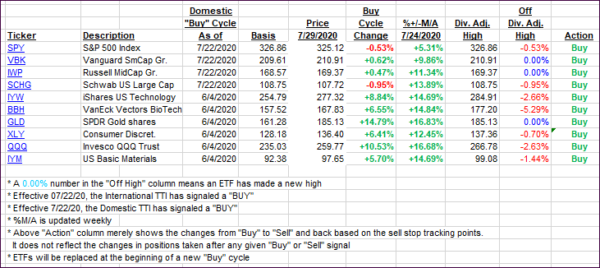

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs rallied sharply confirming the current bullish theme.

This is how we closed 07/29/2020:

Domestic TTI: +4.25% above its M/A (prior close +2.56%)—Buy signal effective 07/22/2020

International TTI: +2.04% above its M/A (prior close +1.78%)—Buy signal effective 07/22/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli