- Moving the markets

While all three major indexes raced ahead and closed with solid gains, it was the Nasdaq, and to a lesser degree the S&P 500, which had to dig themselves out of a deep hole early in the session, as red numbers dominated.

The late day pump came from none other than Fed Governor Brainard, who called for a sustained large-scale asset purchase by the US Central Bank to help the economy rebound amid a “thick fog of uncertainty” brought on by Covid-19.

There you have it; how much more of a wink with a fencepost can you get? Especially, ahead of a devastating earnings season, confirming once again that fundamentals no longer matter, and we are clearly witnessing a centrally planned market environment.

Brainard also warned that the U.S. economic recovery likely “will face headwinds for some time,” and require further accommodation, while speaking during a virtual event hosted by the National Association for Business Economics.

Regarding the latest on Covid-19, ZH summed it up like this:

- Spain places 160,000 under lockdown

- EU drops Serbia, Montenegro from safe travel list

- Arizona sees big jump with 4,273 new cases

- North Carolina sees record hospitalized

- Alabama reports record rise in deaths

- Moderna releases latest clinical trial update

- TMC releases latest Houston numbers

- Philly bars all public events until Feb 2021

- Florida positivity rate jumps to 15%+

- Florida reports biggest jump in deaths

- India places Bangalore back on lockdown

- US daily cases below 60k

- Global daily cases below 200k

- Hong Kong imposes new restrictions

- France makes mask wearing mandatory in public

- Australia cases top 10k.

- Iran closes mosques, schools

- WHO warns: “there will be no return to normal”

For a change, we saw the Nasdaq lag again with the Dow outpacing it for the third straight day, but still trailing severely on a YTD basis.

Earnings season is on deck with JPM beating expectations despite soaring credit losses, while Wells Fargo’s CEO was “extremely disappointed” with its first quarterly loss since 2008.

More earnings reports, up and down, will be forthcoming, but to me it will be interesting to see, how much interference the Fed will run, should the markets start to get wobbly.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

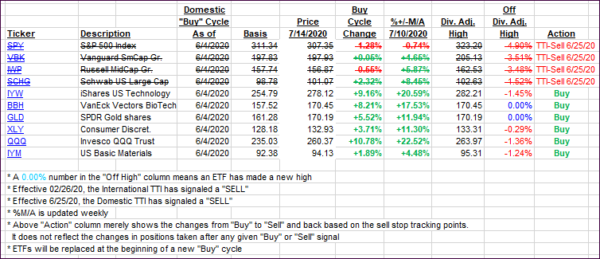

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this new domestic “Buy” cycle, which ended effective 6/25/2020, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs made good headway today with both being within striking distance of breaking their trend lines to the upside.

This is how we closed 07/14/2020:

Domestic TTI: -0.14% below its M/A (prior close -1.73%)—Sell signal effective 06/25/2020

International TTI: -0.06% below its M/A (prior close -0.68%)—Sell signal effective 02/26/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli