- Moving the markets

For most of the session, the markets engaged in directionless wandering but, as we’ve seen many times in the past, an afternoon ramp pushed the 3 major indexes solidly in the green, while pulling the lagging Nasdaq along for the ride.

Two concerns kept the indexes stuck in a range, namely fears that the pandemic is worsening and the rapidly deteriorating US/China relations. Regarding the latter, the US instructed China to close its consulate in Houston provoking consequences that are unknown at this point.

In the end, equities shook off all concerns, and we rallied into the close leaving all issues in the rear-view mirror—for the time being.

In terms of earnings, MarketWatch added:

Thus far, quarterly results have been better than feared. Of the 58 companies that have reported results thus far, 77.6% have reported above analyst expectations, compared with the average of 65% who reported above consensus estimates in prior quarters, according to data from Refinitiv, based on data going back to 1994. A little over 22% have reported results that fall below expectations, versus an average of 21% missing, the data show.

As announced yesterday, both of our Trend Tracking Indexes (TTIs) signaled a new “Buy.” We received confirmation this morning when the markets held steady and did not sell off. Our Domestic TTI took another jump today validating the current bullish theme. See section 3 for more details.

Also, GLD, which we hold, turned out to be the winner of the day again with another solid showing of +1.52%. Thanks to the Fed, and its reckless money printing efforts, the precious metal has far more upside potential than what we have seen to this point.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

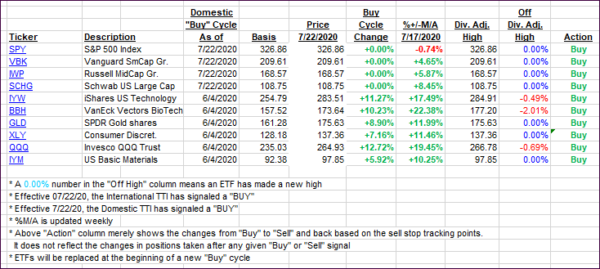

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this new domestic “Buy” cycle, which ended effective 6/25/2020, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Both of our TTIs confirmed yesterday’s “Buy” signals, as the markets were steady and did not sell off.

Again, if you follow along, you should consider your risk tolerance before investing and always apply my recommended sell stop discipline.

As I said before, these Buys signals will have only a minor effect in my advisory business, since we already were invested in a variety of sector funds, which run on their own cycles.

This is how we closed 07/22/2020:

Domestic TTI: +3.68% above its M/A (prior close +2.85%)—Buy signal effective 07/22/2020

International TTI: +2.39% above its M/A (prior close +2.52%)—Buy signal effective 07/22/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli