- Moving the markets

Today’s market theme was the same one like yesterday with traders focusing on easing Covid-19 lockdowns, while the ever-increasing civil unrest and riots were again ignored.

Destroyed businesses and subsequent curfews certainly will impact an economy under stress, especially one that is trying to slowly re-open and is now threatened again with new interruptions.

It’s hard to believe that the events of the past few days have not affected stocks, which seem oblivious to anything else other than being focused on taking out the old highs. Go figure…

“Most people on Main Street think it’s crazy where the stock market is trading, especially on a day where you have major protests happening in the U.S.,” Sam Hendel, president of Levin Easterly Partners, a New York asset management firm, opined.

For sure, it remains to be seen if this “hear no evil, see no evil” market attitude can prevail, which all depends on whether current riots can be brought under control quickly. If this dilemma drags on for any length of time, I believe that stocks will shift into reverse in a hurry.

As I have posted many times, liquidity is the oil that greases the wheels of the stock market. We saw a little hiccup, AKA lack of liquidity, into the close today when the S&P 500 surged 10 points in one tick, as a $3.2 billion MOC order (Market On Close) could not be have been filled otherwise. As luck would have it, it was a Buy order, thereby helping the bullish cause.

Zero Hedge had the best closing analysis about today’s events:

While we are constantly told that Black Lives Matter, Blue Lives Matter; in fact, truth be told, ALL LIVES MATTER; but, there is one thing that matters more… higher stock market prices…

Former PIMCO chief Mohamed El-Erian saw it this way:

“This notion that it doesn’t matter what happens to fundamentals. It doesn’t matter what happens to corporate earnings. It doesn’t matter what happens to economic growth… because The Fed will buy what I want to buy… that’s the mindset of the market right now.”

Whatever you decide to do, do not enter these markets without an exit strategy.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

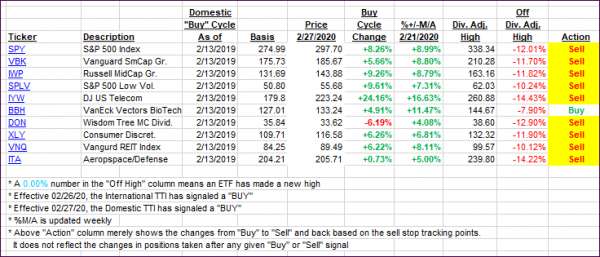

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this past domestic “Buy” cycle, which ended on 2/27/2020, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs jumped with the Domestic one now being within striking distance of a new “Buy” signal.

This is how we closed 06/02/2020:

Domestic TTI: -1.03% below its M/A (prior close -2.26%)—Sell signal effective 02/27/2020

International TTI: -4.68% below its M/A (prior close -6.04%)—Sell signal effective 02/26/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli