- Moving the market

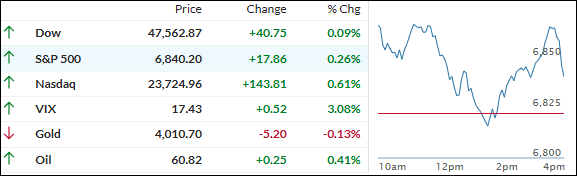

The week kicked off with the Nasdaq as the only major index in the green, riding the AI wave hard after a flurry of big deals.

Amazon, a Mag 7 heavyweight, jumped 4% on news of a $38 billion partnership with OpenAI—and get this, it’ll gobble up hundreds of thousands of Nvidia GPUs.

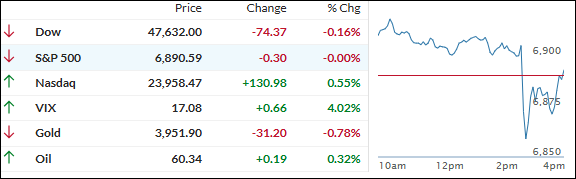

That lit a fire under chip stocks too: Iren (a data center player) soared 19% after locking in a $9.7 billion multiyear deal to supply Microsoft with Nvidia’s next-gen GB300 GPUs. Micron led the pack with a 4% pop, Nvidia added 2%, and the VanEck Semiconductor ETF (SMH) climbed 1%.

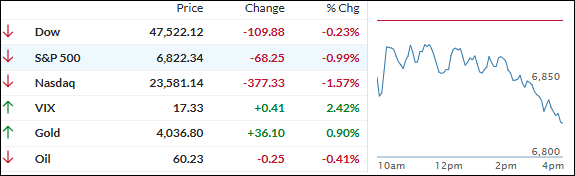

But outside tech? Crickets. Over 400 S&P 500 stocks closed lower—classic weak breadth, even though the index still squeaked out a gain.

I think this split personality is the real story: AI keeps lifting the market, but most stocks are struggling. We’re now 80%+ through Q3 earnings, with over 80% beating estimates—solid, but the love’s all going to the usual suspects. This week, Palantir and AMD drop their numbers, so expect more AI drama.

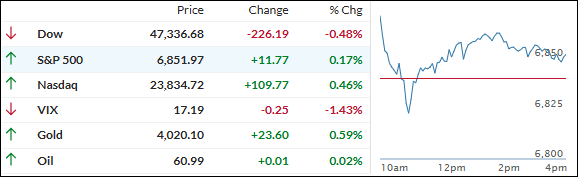

In the end, S&P 500 and Nasdaq closed green, while the Dow and small caps stumbled. The most-shorted stocks had their worst day in two weeks—ouch.

Bond yields ticked up as December rate-cut odds faded, the dollar kept flexing, gold dipped overnight but bounced back above $4,000, and bitcoin slid toward $107K.

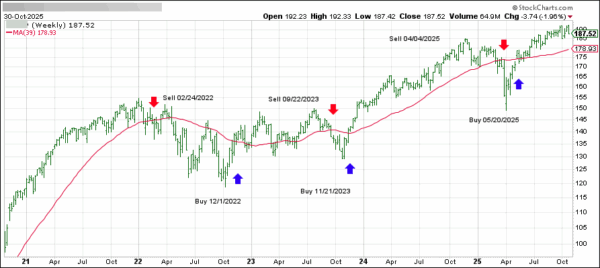

November’s historically the S&P’s best month—up 1.8% on average. Will the AI train keep rolling, or will weak breadth finally matter?

Read More