- Moving the market

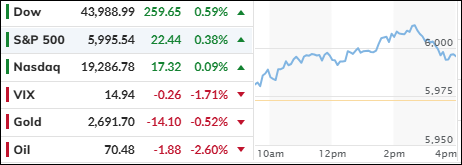

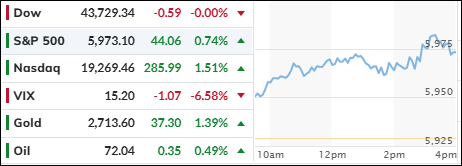

The markets began the session moving sideways to lower, as traders appeared to take a breather from the highs reached in the post-election rally.

Bond yields climbed, with the 10-year yield advancing nearly 0.12% to close at 4.43%, marking its highest level in five months. This increase in bond yields was sufficient to push equities downward and the dollar upward.

The anticipated short squeeze was notably absent, leading to a significant decline in Small Caps, followed by gold, which dropped to two-month lows due to the dollar’s continued strength.

Bitcoin once again emerged as the top performer of the day, coming within a few dollars of crossing the $90 level, and even briefly surpassing it after hours. The cryptocurrency received substantial support from massive inflows into Bitcoin ETFs.

With the resurgence in global liquidity appearing robust, Bitcoin seems poised to potentially surpass the much-anticipated $100,000 price point.

Will it happen this month?

Read More