- Moving the market

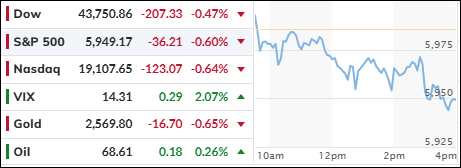

The major indexes ended the day with mixed results, as only the S&P 500 and Nasdaq managed to close in the green. The Nasdaq received a significant boost from Tesla, which surged approximately 7% following news of potential regulatory easing for self-driving vehicles.

Traders are now turning their attention to Wednesday’s earnings release from chip giant Nvidia, which could influence the market’s near-term direction. Additionally, upcoming reports from key retailers are expected to provide valuable insights into consumer behavior and the broader economy.

Last week was challenging for the major indexes, which retreated from their post-election highs due to concerns about the Federal Reserve’s interest rate trajectory. Despite the Fed’s accommodative stance, having lowered rates by 0.5% and then 0.25%, the markets reacted negatively, with the 10-year yield rising sharply instead of falling.

Bond yields initially spiked but then lost momentum, reversing course, and closing lower. Bitcoin underwent a volatile session, trading within a range and ending slightly higher, maintaining its post-election gains. Gold, after a recent sell-off, rebounded with a 1.7% gain, while crude oil also recovered, reclaiming the $69 level.

Interestingly, Bitcoin and gold, which had been rallying in tandem, diverged after the election. Bitcoin surged higher, while gold faced profit-taking.

Will they be able to sync up again?

Read More