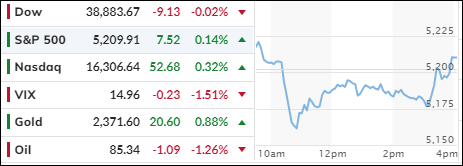

- Moving the markets

In a volatile trading session, the major stock indexes initially declined but ultimately recovered, as investors sought to regain optimism before the release of pivotal U.S. inflation data.

The early downturn lacked a clear trigger, suggesting that apprehension over the forthcoming Consumer Price Index (CPI) report dominated sentiment. However, strategic dip buying at lower prices helped the markets rebound by the close.

Chipmaker Nvidia saw its shares fall by 2.4%, while other prominent technology companies like Meta and Netflix also experienced declines of 0.6% and 1.6%, respectively.

The March CPI report, a critical indicator of inflation, is scheduled for release on Wednesday at 8:30 a.m. ET. Analysts anticipate a 0.3% rise in inflation for March compared to the previous month.

Investors are closely monitoring this data for hints about the Federal Reserve’s timeline for interest rate reductions. Currently, opinions are split on whether the Fed will lower rates in June.

The markets have been stagnant recently, reflecting concerns about the Fed’s resolve to decrease interest rates. An unexpectedly high CPI figure could trigger a market correction.

Market analysts believe that any significant deviation from expectations could cause market volatility. This is attributed to the current high valuations, which leave little room for error in economic data or geopolitical developments without causing rapid market selloffs.

Federal Reserve spokesperson Bostic’s mixed messages in the final minutes of trading did not cause a major stir, but they were interpreted positively by algorithmic trading systems, which helped lift the indexes from their lows. Despite this, the MAG7 stocks’ attempted rally ultimately failed.

Broadly, the favored AI stocks have made no significant progress in the past six weeks. Meanwhile, Boeing’s decline continued, Bitcoin relinquished its recent gains, and crude oil struggled to maintain its position above the $85 mark.

Bond yields fell, with the 30-year bond reversing its post-payroll increase. The U.S. dollar fluctuated but ended slightly higher. Amidst this uncertainty, expectations for a rate cut grew, and gold reached a new all-time high.

Will the upcoming CPI report clarify or compound the current market uncertainties?

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

During today’s trading session, uncertainty prevailed, causing the major stock indexes to remain predominantly negative. However, towards the end of the session, dip buyers entered the market, leading to a recovery that resulted in a positive closing for both the S&P 500 and the Dow Jones Industrial Average.

As for our TTIs, there was a varied performance. The International TTI saw no change, indicating stability in international markets. Meanwhile, the Domestic TTI experienced a slight increase, suggesting a modest improvement in the domestic market.

This is how we closed 4/09/2024:

Domestic TTI: +10.68% above its M/A (prior close +10.25%)—Buy signal effective 11/21/2023.

International TTI: +9.72% above its M/A (prior close +9.72%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

—————————————————————-

Contact Ulli