ETF Tracker StatSheet

You can view the latest version here.

WALL STREET STUMBLES AFTER FED RATE CUT ODDS PLUNGE

- Moving the market

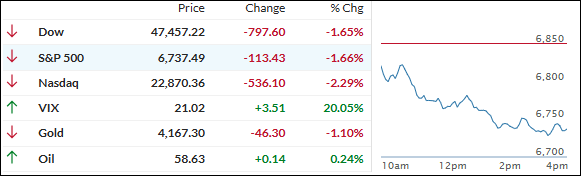

U.S. stocks slid again right after the opening bell, capping off a tough couple of days and notching their worst single day drop since early October.

The Dow erased nearly 800 points, undoing Wednesday’s gains and the recent milestone push above 48,000, while the Nasdaq fell more than 2%, putting its impressive seven-week winning streak at risk as technology giants took heavy losses.

Wall Street’s anxiety was stoked by valuation concerns in artificial intelligence stocks (with Oracle in particular rattling investors), plus rising debt levels and massive spending for future AI infrastructure.

On top of this, doubts are mounting about the likelihood of a Federal Reserve rate cut in December—rate cut odds have plunged from over 95% to just above 51% in recent weeks, leaving traders on edge about the path forward.

The end of the government shutdown was expected to bring clarity, but instead there’s worry some economic data may never be released.

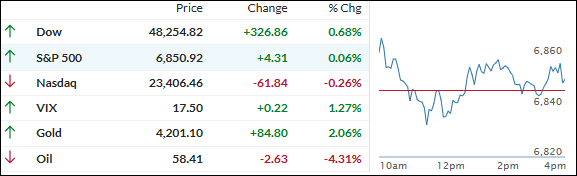

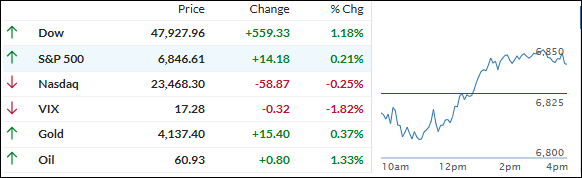

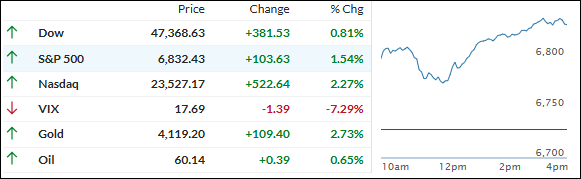

Technical support helped slow the decline, with the S&P 500 and Mag 7 basket bouncing back slightly but still ending the week flat.

Outside equities, gold managed to rebound 2% for the week and break its losing streak, while silver outperformed despite late-week selling.

Bitcoin fell to $94k—its lowest in six months—as outflows from bitcoin ETFs accelerated and the coin separated from its usual correlation with the Nasdaq.

Will next week’s sessions offer more clarity, or is uncertainty going to be the market’s constant companion as we approach year-end?

Read More