- Moving the market

The morning started like a dream: Nvidia dropped an absolute monster quarter—beat earnings, smashed revenue, and gave guidance that had Jensen basically saying, “Blackwell demand is insane, no bubble here.”

The stock jumped 4% pre-market, the whole AI ecosystem lit up (AMD, Broadcom, Eaton—you name it), and everyone thought the AI bull was officially back in charge.

Then the September jobs report hit: 119K jobs added (better than feared), but the unemployment rate ticked higher.

That flipped the script—December rate-cut odds actually rose mid-session (traders love a little labor-market weakness). Everything looked golden… until it very much wasn’t.

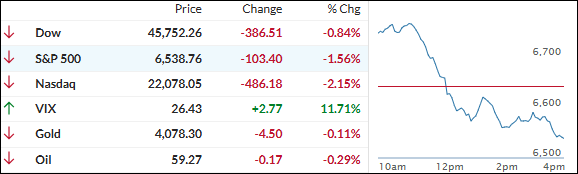

By afternoon it turned into one of the nastiest reversals I’ve seen all year. Nasdaq swung a ridiculous 5% from high to low and never recovered. Mega-caps, retail darlings, pretty much everything got taken out back and spanked.

Nvidia closed down on the day—yes, you read that right—after being up double-digits intraday. Classic “pump it, dump it” move.

Bonds caught a safe-haven bid (yields dipped), bitcoin got crushed below $90K (lowest since April), and the dollar crept higher.

The only quiet winner? Gold—just sat there like a champ and closed basically flat in the middle of all that chaos.

Tomorrow we’ve got the biggest November options expiration ever—$3.1 trillion notional. Translation: seatbelts might still be required.

Read More