- Moving the Markets

It was a choppy session with macro data serving another notice that economic conditions are weakening, a theme I have been pounding on for quite some time. Today, things started with disappointing U.S productivity, the key to a high living standard, which declined at an annual pace of 0.6% for the 1st quarter 2017 (far worse than the expected 0.1% decline).

That was followed by another hard data miss, namely factory orders that rose 0.2%, which was half of the expected gain of 0.4%. The core orders (without transportation) looked worse, as they stumbled 0.3% the biggest drop since February 2016.

The third try turned out to be a charm as Obamacare was successfully repealed but faces serious senate bickering, which may lead to a significant rewrite of the legislation.

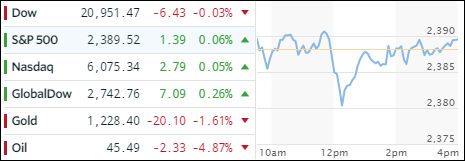

Equities were muted and danced around the unchanged line all day with nothing to show for. The loser of the day award goes to Oil, which was spanked at the tune of -4.87% closing below $46/barrel.

With June rate hike odds still hovering at 90%, it came as no surprise that Treasury yields rose with the 10-year adding 3 basis points to 2.36%, which is quite a jump off the recent 2.18% lows. The US dollar (UUP) slipped and has now clearly broken below its 200-day M/A. While the dollar and the S&P 500 roughly move in sync, that relationship has widened as the chart shows: