- Moving the Markets

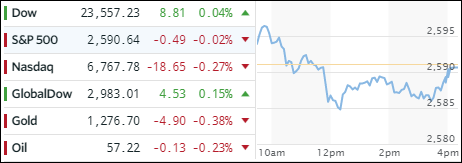

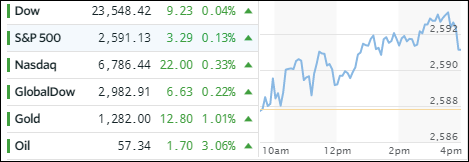

It appears that we’re back to normal—the new normal that is. I am talking about the pattern we’ve come to know very well this year. Namely, a weak opening followed by a mid-day bounce and a strong finish accompanied by new all-time highs. That’s exactly what we got, as the major indexes scored simultaneous records on the same day for the 27th time this year.

Hope prevailed that market fundamentals are justified (they’re not), the economy is expanding (very questionable if you look at record retail store closings) and that Trump will deliver on his tax cuts (no assurances). However, none of these concerns matter as long as there is hope, the markets will take that as a positive. However, just in case that wasn’t enough, the VIX was crushed below 10 again to ensure a green closing.

In ETF space, we saw mainly green numbers. Leading the pack was Emerging Markets (SCHE) with +0.51% joined by International SmallCaps (SCHC) and International Equities (SCHF) with gains of +0.36% and +0.35% respectively. Financials (XLF) headed south by giving back -0.49% along with Transportations (IYT) losing -0.39%.

Interest rates were unchanged but High Yield bonds (HYG) continued to slump by not only losing another -0.44% but also hovering now below their 50-day M/A. We’ll have to wait and see if this is just an outlier or a precursor of things to come in regards to higher rates.