- Moving the markets

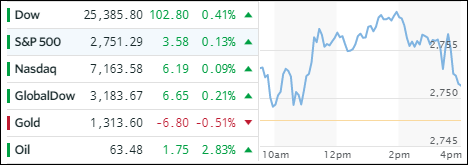

I had to happen eventually and today was the day. The major indexes actually traded below the unchanged line all day, staged a comeback but ended slightly in the red, as some profit taking set in. Caution prevailed as yesterday’s bond slam-fest remained on traders’ minds. The cause of jumping bond yields were reports out of China that they are considering “slowing or halting” purchases of U.S. debt, an event that would definitely accelerate a rise in yields.

With the markets going nowhere, that theme carried over to the ETF space as well, where losers outnumbered gainers. Actually, the only ETFs in our stable of holdings ending in the green were Financials (XLF +0.84%) and Transportations (IYT +0.10%). All others retreated led by the winner YTD, namely Semiconductors (SMH -1.32%), followed by Emerging Markets (SCHE -0.48%) and MidCaps (SCHM -0.35%).

Intra-day, the yield of the 10-year bond climbed another 4 basis points before backing up and ending unchanged at 2.55%. The more interest rate sensitive high-yield arena (HYG) suffered for the second day in a row and closed lower by -0.22%. The US Dollar (UUP) slumped after 3 days straight of gains and lost -0.25%.