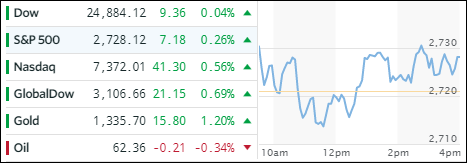

- Moving the markets

While we opened the session on a positive note, equities started slipping and sliding being spooked by early rumors as to who would get Gary Cohn’s job. However, that talk fell by the wayside when news headlines announced not only unlimited exemptions for Canada and Mexico from Trump’s tariffs but also allowed other countries (to be named later) to negotiate exclusions.

That shifted the early downtrend in reverse, and the major indexes crawled out of the basement and back above their respective trend lines to close modestly in the green. Leading our selected ETFs were LargeCaps (SCHX +0.43%) followed by International SmallCaps (SCHC +0.41%) and International Equities (SCHF +0.24%).

Interest rates slipped but came off their lows with the 10-year yield dropping 3 basis points to close at 2.86%. The US Dollar (UUP) rallied nicely, then fell back but still managed to gain +0.64%. Today looked to be one of consolidation and examination as to how the dreaded trade tariff threats may play out. If they indeed turn out to be “softer” than originally announced, meaning that just about any country can individually negotiate their own deal, we might see the rebound in equities become not just less volatile but also pick up some steam.