- Moving the markets

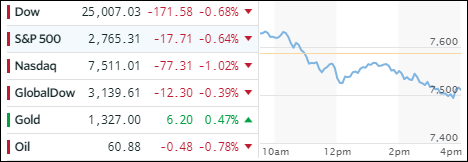

A host of headlines appeared to punish the markets by pushing the major indexes down for the third day in the row. First, there was more jawboning about tough trade talk with China, as the administration announced a $100 billion annual China deficit target from last year’s $375 billion. Of course, retaliation is expected with one of the victims very likely being Boeing, whose stock subsequently got hammered for the second day in a row, which did not bode well for the Dow.

Then there was the matter of the GDP, as the Atlanta Fed (along with Goldman) slashed its forecast from its wild expectations of 5.4% down to a meager and far more realistic 1.9%, in part due to ever weakening retail sales, which had it worst declining streak since 2015. That was enough to take away some of the early bullishness and south we went. Despite a mid-day hiccup, the session was clearly dominated by the bears.

The Producer Price Index (PPI) had wholesale inflation up +0.2% in February (vs. +0.1% expected), but that was down from the 0.4% advance in January.

The VIX rallied above 17 and did its part to keep the markets in check. Interest rates dropped with the 10-year bond yield declining 3 basis points to 2.81%. The US Dollar, which sank for the 3 days in a row, managed to buck its trend by gaining +0.04%.

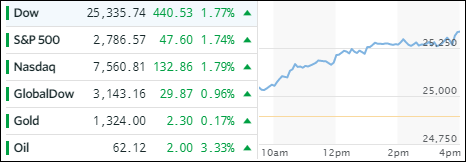

Overall, there was no news that could have boosted the markets. However, some ETFs in our portfolios withstood the negative sentiment as Semiconductors (SMH +0.05%), International ETFs (SCHF +0.26%) and International SmallCaps (SCHC +0.32%) managed to end this session in the green.