ETF Tracker StatSheet

ENDING THE WEEK WITH A WHIMPER

[Chart courtesy of MarketWatch.com]- Moving the markets

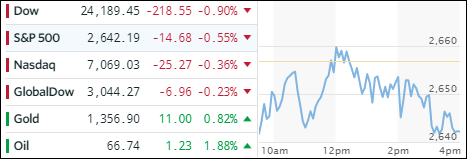

The major indexes came under pressure and surrendered early gains as initial reads on the upcoming earnings season disappointed. Expectations have been high about corporate performance maybe in part due to the fact that geopolitical anxieties have painted a distorted picture.

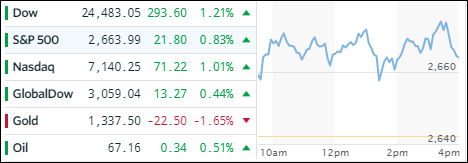

While three major banks showed some better than anticipated report cards today, equities headed south anyway and pushed the financial sector down (XLF -1.51%). Still for the week, the Dow gained 2% while the S&P 500 and Nasdaq added 2.1% and 3% respectively.

Headline news ping-pong was in full swing today including such topics as China trade wars, Comey, Rosenstein, Mueller, Syria, Russia and slumping consumer sentiment, which were all adding to the general confusion in the market place rather than providing much needed clarity.

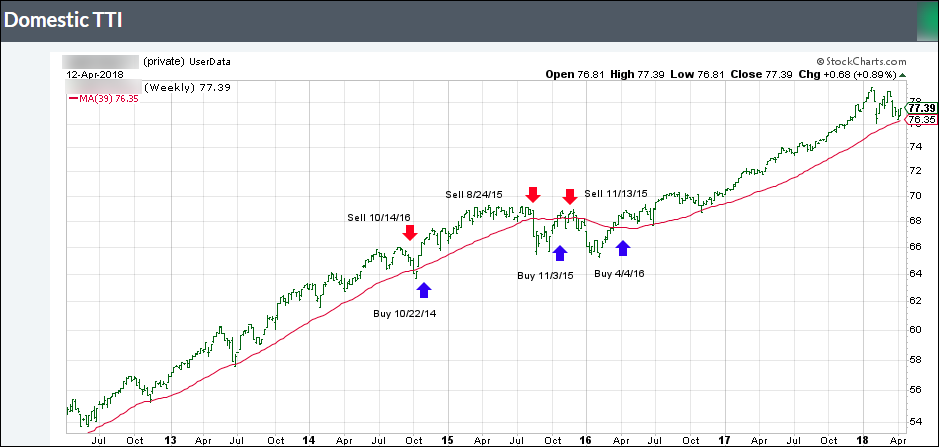

But, these are the roller-coaster times we live in, so we will continue to focus on the only reality we have, which is the major direction of the markets via our Trend Tracking Indexes (TTIs). The trend remains bullish, and we will stay on board until the bears gain the upper hand.