ETF Tracker StatSheet

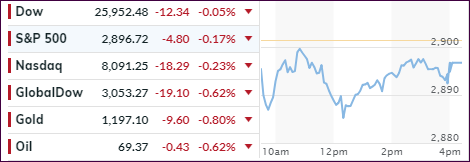

MAJOR INDEXES LIMP LOWER FOR THE WEEK

[Chart courtesy of MarketWatch.com]- Moving the markets

Even a decent jobs report showing that 201k jobs were added in August (vs. 200k expectations), along with a steady 3.9% unemployment rate, couldn’t stem the bearish tide. The major indexes lost for the week with Nasdaq faring the worst with -2.5%.

Bond yields jumped with the 10-year adding 6 basis points to 2.94% as inflation fears were stoked, because of the strongest growth in Average Hourly Earnings (AHE) in 9 years. This now has traders on edge with more interest hikes by the Fed now being a virtual certainty. A growing AHE, when combined with a humming economy, is interpreted as contributory to future inflation.

On the trade side of things, Trump upped the ante with China again when he announced that he is ready to not just greenlight the $200 billion in previously discussed tariffs but also impose another $267 billion that his administration is working on with the tariff rate being unknown so far.

Obviously, the fact that the July trade deficit with China reached an all-time high of $36.9 billion contributed to his decision. Even Apple Computers had to come out and admit that its products would be affected by tariffs causing the stock to drop sharply.

It’s been a rough start of the month for the markets, but after a summer of almost non-existent volatility, some changes were due to happen, and we’ll have to wait and see if this first week was simply an outlier or a harbinger of things to come.