- Moving the markets

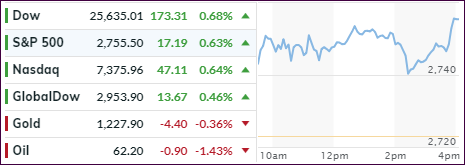

With most of the mid-term election results being on deck later tonight, it came as no surprise that the markets meandered, but with a bullish bias, as all 3 major indexes closed in the green with last minute buying helping the bullish cause, although on ultra-low volume (60% below average).

Polls and forecasts occupied the headlines where opinions varied widely ranging from “what happened to equities after every midterm” to “a healthy 30%-plus correction headed for stocks.” Of course, someone is bound to be dead wrong when you consider totally opposing views.

One investment firm summed the current scenario up this way:

“It is definitely not the time to buy the dip,” said London & Capital’s CIO Pau Morilla-Giner. “Everything that could go well for U.S. consumers in the last couple of years has gone well, but now the tide is turning… At the moment, you are running out of drivers of growth in the U.S.”

I agree with this assessment but will add that momentum can turn quickly even in the face of slowing fundamentals. There could be a relief rally in store, so we need to be prepared to jump back in should our Domestic TTI (section 3) crosses back above its long-term trend line. As of today, we are only -0.41% away from a new “Buy” Signal.

On the other hand, the Fed will make his announcement regarding interest rates tomorrow around noon which, depending on the outcome, could wreak havoc with the markets. It promises to be an interesting next few days.