ETF Tracker StatSheet

Up For The Week But Running Out Of Steam For The Day

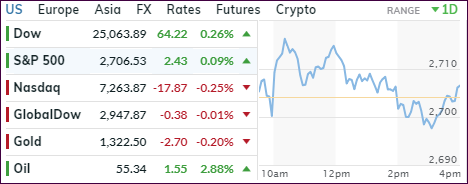

[Chart courtesy of MarketWatch.com]- Moving the markets

Choppy and sloppy best describes the last trading day, a week during which the major indexes gained but ran out of steam, as an early rally faded into the close with the Dow coming off the high by some 150 points.

Despite the Nasdaq notching a 1.4% rise over the past 5 days, today it was the anchor that kept any advances in check predominantly due to Amazon’s earnings announcement that revenues for the Q1 2019 would fall short of expectations. Amazon’s stock price has now been down for 2 straight weeks.

For this week, the S&P 500 advanced +1.6%, the Dow added +1.3% while the Nasdaq gained +1.4%. All thanks to the Fed’s slamming on the monetary brakes and caving to Wall Street by signaling “patience” regarding any future policy changes as opposed to the more hawkish behavior shown 3 months ago.

Interest rates rose today with the 10-year bond yield gaining 5 basis points to settle at 2.68%. The driving factor here was the jobs reports showing that the U.S. gained 304k jobs vs. 172k expected, the biggest increase in almost a year. Of course, this number is subject to the usual at times sharp revisions. Case in point is the December figure, which was slashed from an initial estimate of 312k to 222k.

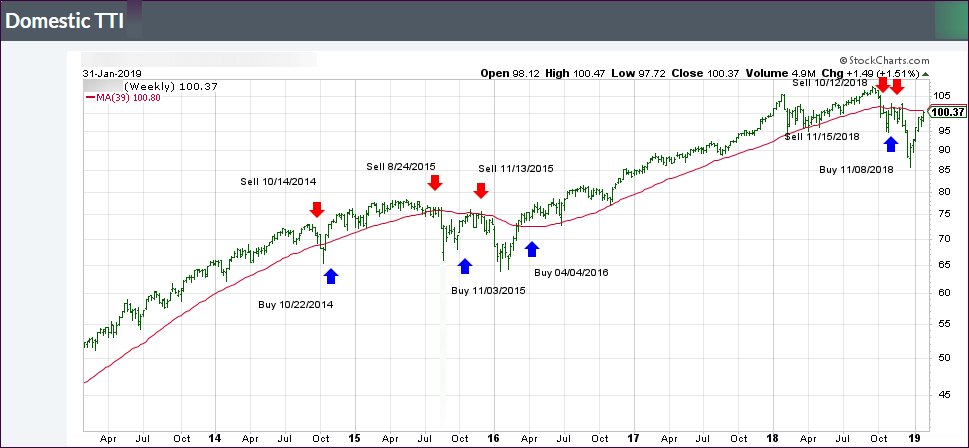

Our Domestic Trend Tracking Index (TTI) inched a tad higher and is now within striking distance of crossing its long-term trend line to the upside and into bullish territory. Please see the exact numbers in section 3 below. If the current bullish sentiment continues, we may very well be inching back into equity ETFs in the near future.